Invoice Factoring

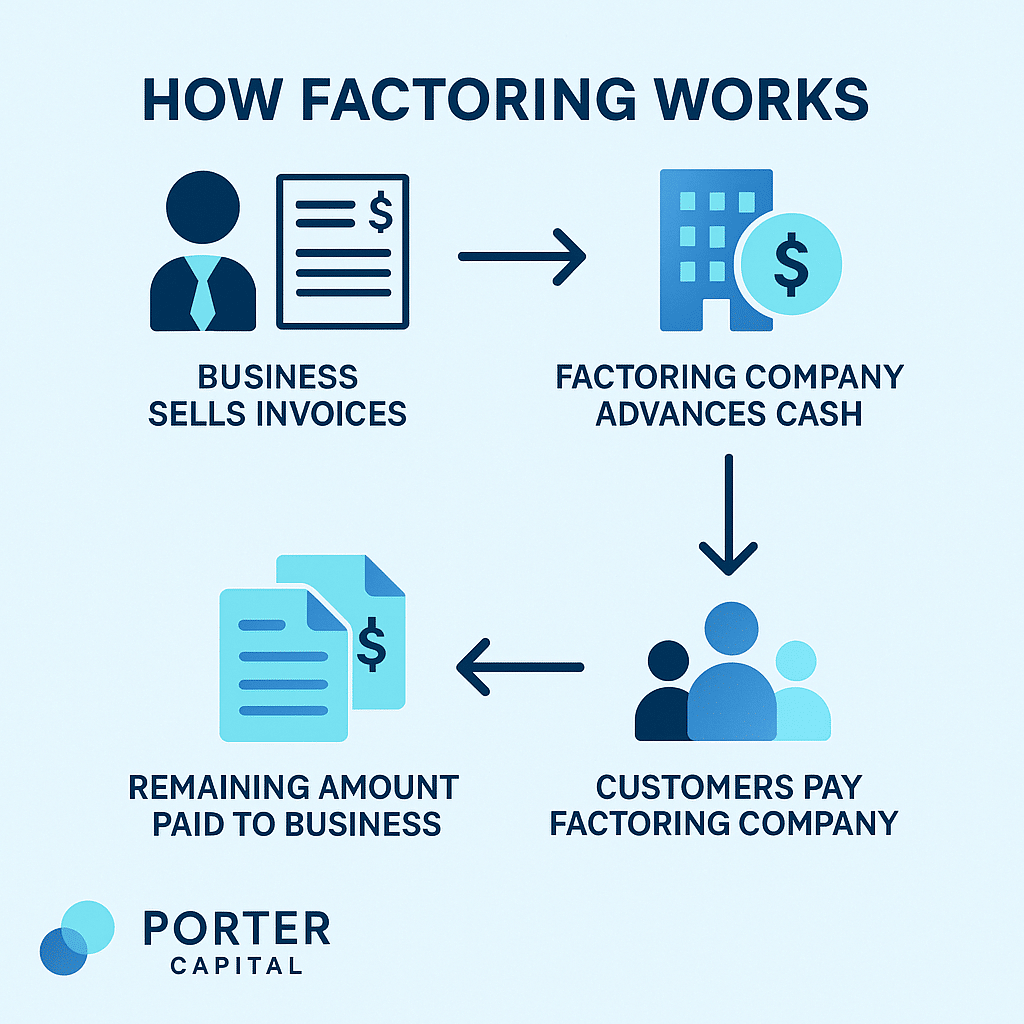

Invoice factoring companies provide businesses with advance payments and immediate access to the working capital needed to hit payroll, purchase more inventory, or just continue expanding operations without giving up equity. The invoice factoring company advances you up to 95% of your invoices’ cash amount, so you don’t need to wait for your customers to pay.

All you need to do is submit your invoices to the factoring company, wait for them to verify each unpaid invoice, and receive compensation for the invoice value.

Instead of waiting 30 to 90 days for a customer to pay, we pay you in as little as 24 hours. Then, once the customer payment for the invoice is received, you get the rest of the amount minus the factoring fee.

Why You Should Use Us For Invoice Factoring

Fast Access to Cash

We advance funds on your receivables and get you approved for funding and factoring services in hours.

Competitive Rates

We pay up to 95% on each invoice, we’re one of the most competitive in the industry.

Flexible Financing

We tailor factoring solutions to your unique situation. Whether you’re coming out of bankruptcy, growing fast or gearing up for growth, we’re here to support you and your invoice financing needs.

Cash Flow

Factoring gives you consistent cash flow, so you can get paid from your outstanding invoices and run your business.

We specialize in working with B2B businesses across a range of sectors

Don’t see your business below, reach out to us – there’s a great chance we work with yours. And if we don’t we will refer you to trusted partner who can!

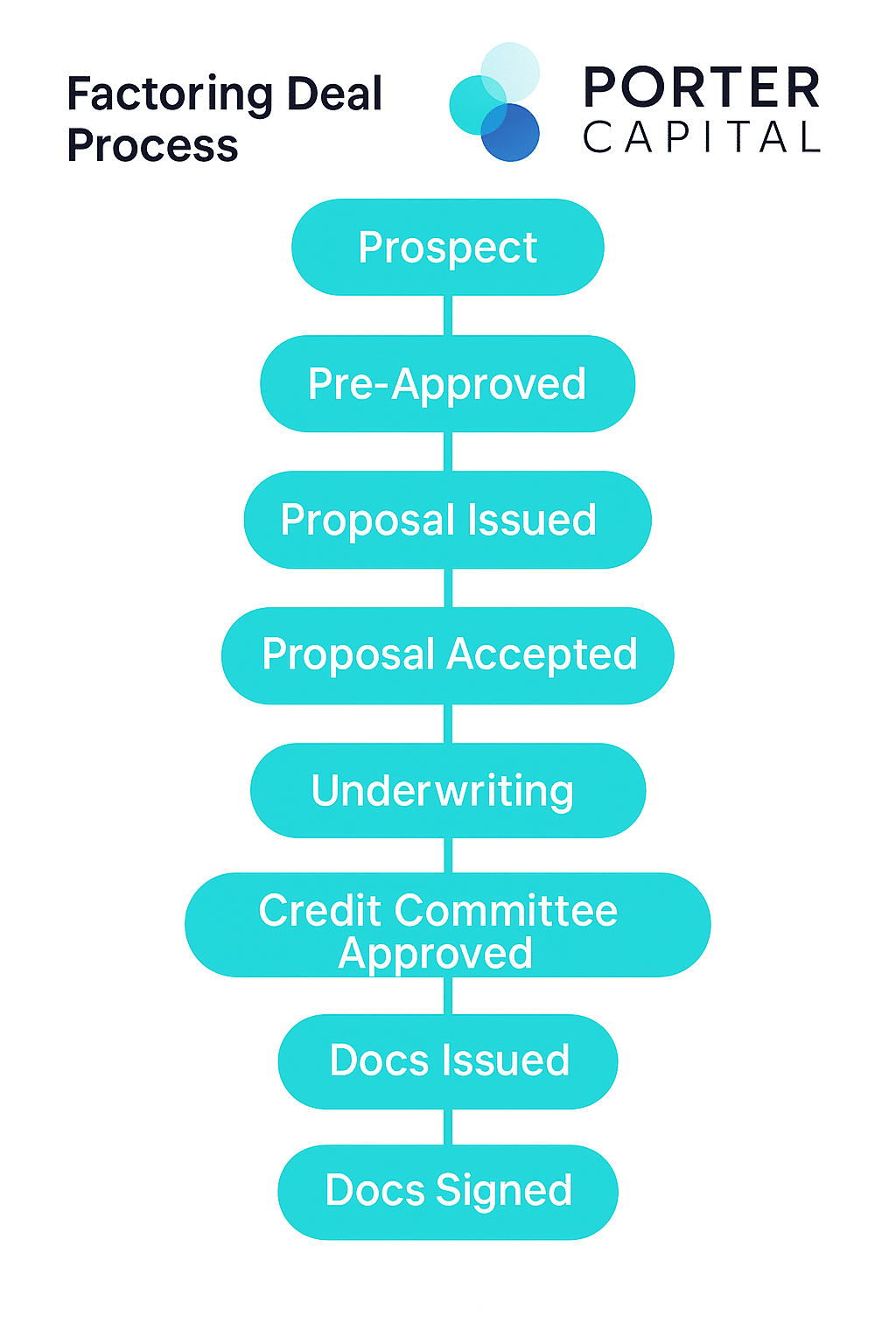

Our Process

One of our core values at Porter Capital is transparency – so we take pride in outlining what our entire factoring process looks like from start to finish. It may look long, but we work fast and can provide funding in as little as 24 hours. We work as fast as you can to respond to us after submitting our form.

You reach out to us, or we connect with you. At this stage, we’re just getting to know each other. We’ll ask some basic questions about your business, how you invoice, and the types of customers you serve. If you’re a B2B company that sells on terms, you’re already off to a great start.

Based on your answers and quick research, we determine if you meet our initial requirements. This includes:

-

Selling to other businesses (not consumers)

-

Invoicing after delivery of a product/service

-

Unencumbered receivables

-

Monthly invoice volume that makes factoring efficient (usually $25K+)

This stage is all about ensuring a good fit before we dive deeper.

Once you’re pre-approved, we send over a proposal that outlines the key details of our offer:

-

Advance Rate (usually around 85–90%)

-

Fee Structure (our discount rate based on time outstanding)

-

Terms and services included (like online dashboard access and credit checks)

This proposal is not a contract—it’s simply a clear, written offer so you know what to expect.

If you like what you see, you give us the green light to proceed. This stage signals serious intent, and we begin collecting more detailed documents for underwriting. You’re not locked in yet, but we start preparing for a deeper evaluation.

Our credit and risk teams take a thorough look at your business. This includes:

-

Analyzing your accounts receivable aging report

-

Reviewing sample invoices and backup documents

-

Evaluating your customers’ creditworthiness

-

Checking for tax liens, bankruptcies, or legal encumbrances

We also verify invoices using methods like verbal confirmation or reviewing proof of delivery.

Once underwriting is complete, your deal is presented to our internal credit committee. If approved, this means we’re confident in your customers’ ability to pay—and we’re ready to move forward.

This is the final green light before paperwork.

We send you the official agreement to review and sign. This includes:

-

The factoring agreement

-

Any necessary UCC filings

-

Details about your lockbox address or remit-to info

You’ll also get a breakdown of how the process will work day-to-day.

You sign the agreement, and your client relationship officially begins. We start preparing your customer notifications and setting you up in our system.

We notify your customers (account debtors) with a Notice of Assignment, instructing them to send payments to your new lockbox. We also train you or your team on:

-

Submitting invoices

-

Tracking advances and rebates in our portal

-

Asking for credit checks on new customers

Once onboarding is complete, you’re ready to start submitting invoices and receiving funding—often within 24 hours.

Try our Factoring Calculator

Use our factoring calculator to see the estimated cash advance, the final amount receivable upon invoice payment and the factoring fee. No email required!

Types of Factoring We Offer

We proudly offer both recourse and non-recourse factoring to our clients. These are two different invoice factoring agreements for accounts receivable. While both provide immediate cash flow and upfront financing benefits, they differ in their mechanics and backend operations.

At Porter Capital we evaluate your unique business dynamics – industry benchmarks, your business size and projected returns on due invoices – to recommend the best financing option for you. Our goal is to find the right financing solution for your business.

Some of our differentiators

- Rates from .4%

- Fast Approval

No Minimum Credit Score to Qualify

30+ Years In Business

Will Fund Past-Due (Outstanding) Invoices

Credit Lines up to $25 Million

Meet Your Point of Contact

We appoint a dedicated operations manager for you when you get started. Instead of automated calls and answering machines that other factoring companies provide – we appoint a real person who deeply cares about your business and partners with you to deliver exceptional factoring services. Leslye is just one of our incredible operations managers.

Get Cash for Your Outstanding Invoices Today

Stop waiting 30 to 90 days to get paid. With Porter Capital you can get the working capital you need, when you need it, to keep your business moving.

Frequently Asked Questions About Invoice Factoring

Invoice Factoring Articles & Resources

Maximize Your Cash Flow with Same Day Invoice Factoring Solutions

Best Same Day Invoice Factoring for Instant Cash Same day invoice factoring lets you turn unpaid invoices into cash in

The Essential Guide to Invoice Factoring for Small Business Success

Benefits of Invoice Factoring for Small Business Owners Invoice factoring for small businesses turns unpaid invoices into immediate cash. This

Is Invoice Factoring a Loan? Understanding the Key Differences

Is invoice factoring a loan? No, it’s not. Invoice factoring means selling your unpaid invoices to get immediate cash and

What to expect after you fill out our 60 second application

- A member of our sales team will call you within 15 minutes if you submitted this during business hours

- We will ensure you are a good fit for our factoring services.

- If you are, we will issue a formal proposal that outlines advance rate, fee structure, and service details.

We can move as fast as you can – meaning we can get you pre-approved in the next 24 hours and begin the underwriting process quickly to ensure you get your funds when you need them.

Looking forward to speaking with you soon.