Table of Contents - Quick Links

In an ideal business situation, cash flows in and out of a company. When a client pays an invoice, your business receives an inflow of cash. When you make a payment, cash flows away from your business. Your company’s cash flow can be positive, meaning more money is coming in than going out. It can also be negative, meaning more money leaves your business than comes in.

While positive cash flow is ideal, many companies find that their cash flow is negative. Negative cash flow can make it challenging for a company to pay its debts or outstanding invoices. Having a negative cash flow can also make it harder to attract investors. Fortunately, businesses can take action to solve their cash flow problems.

Troubled by Cash Flow Problems?

Porter Capital has an array of solutions to help you with common cash flow problems.

How Do Cash Flow Problems Affect Businesses?

Cash flow problems can develop when a business doesn’t have enough cash coming in. The company can look financially healthy on paper, meaning that it theoretically has enough money to stay afloat and cover its costs. But suppose there’s a lag between the time a company needs to pay for a purchase or service and the time it gets paid for the services it provides, and it doesn’t have an adequate amount of cash available. In that case, it can run into difficulty paying its bills and obligations.

A company that’s struggling to manage its cash might experience the following problems:

- Late payments to vendors and suppliers

- Missed investment opportunities

- Late debt payments

- Denied loan applications due to low cash reserves

- Poor reputation

Depending on how long the cash flow issues persist, a business might have to declare bankruptcy or close.

What Types of Businesses Experience Cash Flow Issues?

While any type of business can experience cash flow issues, the problems are usually more common in specific industries. When companies are first getting started, it’s not unusual for them to have trouble managing their cash flow. Initially, a business might have a lot of cash going out and very little coming in. Having a reasonable reserve from the start can help new companies whether any cash flow challenges. Once the company starts getting paid, it will hopefully see its cash flow balance and become positive.

Cash flow problems can be more likely to occur in businesses in certain industries, such as:

- Construction companies: Construction companies can develop a negative cash flow due to the length of their invoice payment terms. It’s not uncommon for construction companies to issue invoices with 90- or 120-day payment terms. That means the company can wait anywhere from three to four months after a project is finished to receive payment. At the same time, the company will likely start new projects and need to put up the cash to purchase supplies and pay employees.

- Recruitment and staffing companies: Companies that recruit employees for other businesses typically work without getting paid upfront. They might get a retainer from their client but won’t see their commissions until employees begin working. Once a recruit starts the job, it can be several months before the recruiting company gets paid. In the meantime, the staffing company still has bills to pay, which can create a negative cash flow.

- Utility companies: Smaller utility companies might experience cash flow difficulties if they have a lot of customers who don’t pay or who regularly pay late. The utility provider might not have the cash reserves available to cover the differences between the amounts people owe and the amounts they pay. The provider can sometimes cut off service to non-paying clients, but doing so won’t necessarily mean they get paid past-due amounts.

- Wholesalers: Wholesalers that sell their products to retailers or other large companies can experience cash flow problems due to their negotiated payment terms. It’s not uncommon for larger retailers or suppliers to negotiate long payment terms, such as 90 days. A wholesaler can provide the materials or products their clients need and wait up to three months for payment. In some cases, waiting months for payments can make it less likely for the wholesaler to get the money it’s owed.

- Manufacturers: Manufacturers can also experience cash flow difficulties due to long payment terms. Some produce more stock than needed and spend too much on materials they don’t need or can’t sell.

- Leasing agencies: Companies that lease properties might also have cash flow difficulties for reasons similar to those of a utility provider. A tenant might not pay on time or might miss rent payments. Similarly, a company can have difficulty finding a suitable tenant for a property, meaning it remains empty and doesn’t bring in income for months.

10 Causes of Common Cash Flow Problems

Small business cash flow problems can occur for various reasons. Understanding what’s behind your company’s cash flow concerns is the key to fixing them.

1. Poor Bookkeeping and Financing Processes

In some situations, cash flow issues stem from limited accounting practices or poor bookkeeping. When a business is first getting started, it might not have the funds to afford to hire a full-time accountant or bookkeeper. It’s not uncommon for founders or small business owners to figure they’ll take care of the books themselves.

But then other matters get in the way, and the owner can’t keep up with the books. It can also be the case that a company’s books become too complicated for an owner to manage on their own. Expenses can fall through the cracks, and budget details can be missed. Any discrepancies in a company’s books can affect its cash flow. A company might not realize how much is going out versus how much cash is coming in.

2. No Cash Flow Budget

If a company doesn’t know how much money is coming in and going out each week or month, keeping a positive cash flow can be challenging. Many companies can benefit from creating a cash flow budget to keep tabs on income and expenditures.

A cash flow budget is also known as a cash flow forecast. It’s not set in stone and can change based on a company’s circumstances. For example, a late-paying customer can affect the forecast, as can a customer who pays earlier than expected.

Creating a cash flow budget is relatively simple. Estimate the amount of cash your company expects to receive during a period, such as a month or quarter. Then estimate how much you expect to spend during that same period. A ballpark figure for income and expenditures can help you plan and be proactive about potential cash flow concerns.

3. Unexpected Growth

Most businesses want to grow and consider growth a good thing. But there are cases when growth happens too quickly or is unexpected. Those situations can affect your company’s cash flow. For example, if many new customers sign up for your services in a particular month, your company will have to provide services or products, usually before getting payment. That can make it difficult to meet your obligations or keep up.

4. Seasonality

Similar to unexpected growth, seasonal fluctuations can affect your business cash flow. An uptick in demand for your company’s products can mean that you must hurry to get products out of the warehouse or factory and onto the shelves of your customers’ stores. Once the season ends, though, you might be left with unsold stock and no way to sell it until the following year.

Learning how to forecast sales accurately can help your business weather seasonal changes in demand.

5. Buying Too Much Inventory

You might feel like Goldilocks trying to get your stock levels just right. Ideally, you’ll buy just enough inventory to avoid stock-outs and excess. If your company purchases too much, it might over-invest in products that end up sitting unsold. Your company can experience cash flow problems due to excess inventory since you’ve paid for the product but aren’t able to sell it.

Inventory management software can help you strike the right balance and avoid over or under-buying.

6. High Overhead Costs

Every business has overhead, but the amount of overhead can vary. If your company’s expenses are too high, they can eat into your cash flow. If you’re struggling to make ends meet each month or quarter, it can be worthwhile to investigate ways to reduce overhead. That can include negotiating with your landlord for a lower rent, purchasing less expensive materials or reducing unnecessary expenses.

7. Small Profit Margins

You might want to be known as the company that provides the best products at the best prices, but doing so can eat into your company’s profit and affect its cash flow. The smaller your company’s profit margins, the more likely it is to have cash flow problems.

The solution might be to increase your prices or find materials that cost less.

How To Use the Cash Flow Margin Calculator

- Fill in net income.

- Fill in depreciation and amortization.

- Fill in the increase in net working capital.

- Fill in sales revenue amount.

- Press Calculate.

8. Outstanding Invoices

Late or non-payment from customers can affect your business cash flow. The same is true when you give customers an extended period to pay, such as more than 60 days. Reviewing your invoice payment terms and adjusting them as needed can be useful. Also, you might consider checking customers before offering your services to them so you only work with clients with a good history of timely payments.

9. Limited Cash Reserves

Cash reserves can keep your company afloat during lean periods or if you experience an unexpected drop in sales. Many companies simply don’t have enough reserves available to continue operating if money runs tight or clients don’t pay on time.

10. Large Amounts of Debt

Businesses can get in over their heads with debt. Your company might have taken out a loan with a high interest rate or have debts with monthly payments that strain your budget. Add in a cash crunch, and you might be feeling a bit strained.

Minimizing debt can help you make your cash flow positive. Your company might benefit from refinancing loans or consolidating several debts into one loan with a lower interest rate.

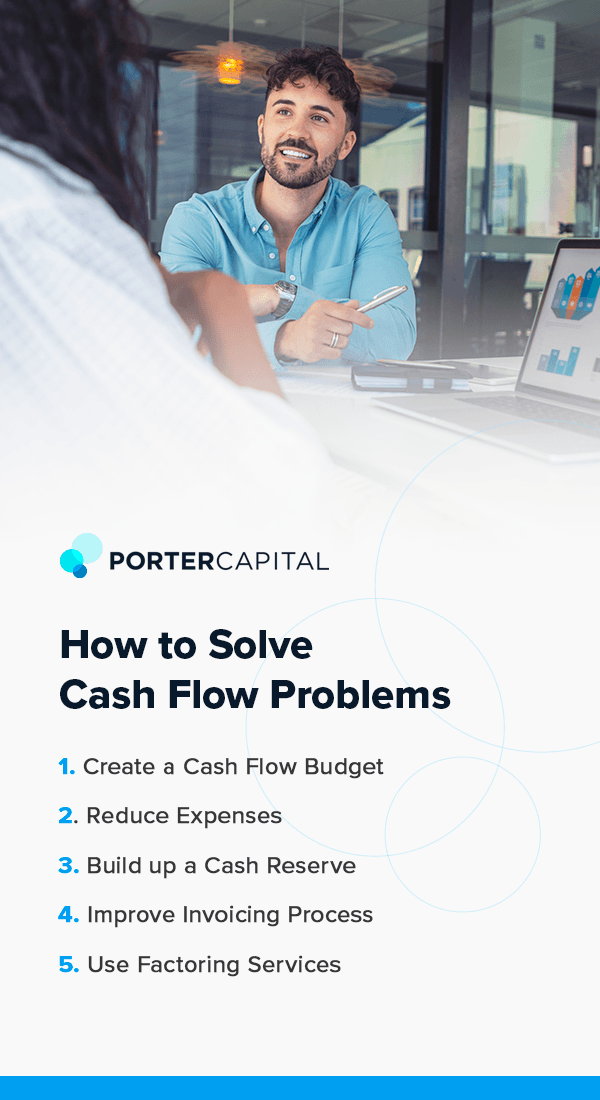

How to Solve Cash Flow Problems

The best way to avoid cash flow problems is to be proactive. Solutions to cash flow problems can include making a budget or forecast, cutting back on expenses and using factoring services to bridge the gap between accounts receivable payments.

1. Create a Cash Flow Budget

A cash flow budget or forecast uses your company’s history to predict its outgoings and income in the near future. The budget can guide any decisions you make about purchases or spending. In a month or quarter when you expect to have a surplus, you can plan on making a large purchase. When you anticipate a deficit, you can tap into reserves or use other options to keep your cash flow balanced.

2. Reduce Expenses

If high expenses contribute to your company’s cash flow issues, finding ways to cut costs will help. You have several options when it comes to trimming expenses:

- Eliminate subscriptions or services your company no longer needs

- Switch to a lower-cost supplier

- Move headquarters or offices to a less expensive location

- Cut back on non-essentials, such as flowers for the office, coffee services and travel expenses.

3. Build up a Cash Reserve

A cash reserve helps your business make ends meet when cash inflow is low. During periods when a surplus comes in, set aside a certain amount of the surplus to serve as a reserve. Keep your cash reserves relatively liquid so you can access them in a pinch when needed.

4. Improve Invoicing Process

If delayed payments contribute to your company’s cash flow issues, finding ways to improve your accounts receivable will help. One option is to reduce the time clients have to pay their invoices. Instead of 60-, 90- or 120-day terms, use 30-day terms. If clients are hesitant to accept, you can consider offering a discount for early payments.

Streamlining the payment process will also help. Give clients multiple ways to pay, such as by check or credit card. If necessary, let each client use multiple payment methods per invoice.

You might also find it helpful to break up your invoices into smaller portions. Instead of waiting until the end of the project to invoice, send a bill as each part is completed or weekly. Your client might appreciate paying in smaller increments, and your business won’t be left waiting for a large payment in the end.

5. Use Factoring Services

Another option is to sell your unpaid invoices to a factoring service. With invoice factoring, you receive an advance on your accounts receivables, usually for up to 95% of the invoice value, minus a small fee. The upfront payment can help your company weather any cash flow ups and downs and help you stay afloat when clients are slow to pay.

Porter Capital Can Help With Cash Flow Problems

Getting on top of your cash flow is key to your company’s ongoing success. Porter Capital helps businesses in various industries manage their cash flow and overcome common problems. We’ve provided more than $6 billion in funding in the form of loans and factoring since the company started in 1991.

Contact us today to learn more about how we can help you solve your cash flow problems.