Best Same Day Invoice Factoring for Instant Cash

Same day invoice factoring lets you turn unpaid invoices into cash in a day. This financing solution is for businesses that need cash flow to cover operational expenses, payroll and other urgent costs. In this article you’ll learn how same day invoice factoring works, the benefits, costs and how you can qualify.

Key Points

- Same day invoice factoring gives you cash by turning unpaid invoices into cash, stability and cash flow management.

- You submit invoices to a factoring company and they approve and disburse funds quickly, often in the same day, so you can have flexible financing without debt.

- While good, you need to be aware of the costs and hidden fees and evaluate customer creditworthiness to mitigate financial risk.

What is Same Day Invoice Factoring

Same day invoice factoring is a financing method that lets you turn unpaid invoices into cash in a day. This is perfect for businesses that need working capital to manage operational costs, payroll and other expenses without waiting for delayed payments from clients. With same day invoice funding you can get the cash you need without delay.

Working with an invoice factoring company lets you submit your outstanding invoices and get a cash advance and keep cash flow and financial stability.

What is Same Day Invoice Factoring

Same day invoice factoring is a financing service that gives you cash by turning unpaid invoices into cash in a day. You sell your open invoices to the factoring company and get funds quickly. This financial service lets you get cash from your outstanding invoices almost instantly. For small businesses and startups with cash flow problems this is a game changer, you get the cash flow you need to cover operational expenses without waiting for client payments.

Through same day invoice factoring you get funds instantly, often in the same day, so you can make payments on time. This is perfect for off hours, weekends and holidays so you can have cash flow even when you need it most. Same day funding can speed up this process.

Using same day invoice factoring helps you manage your cash flow better and address financial shortfalls sooner.

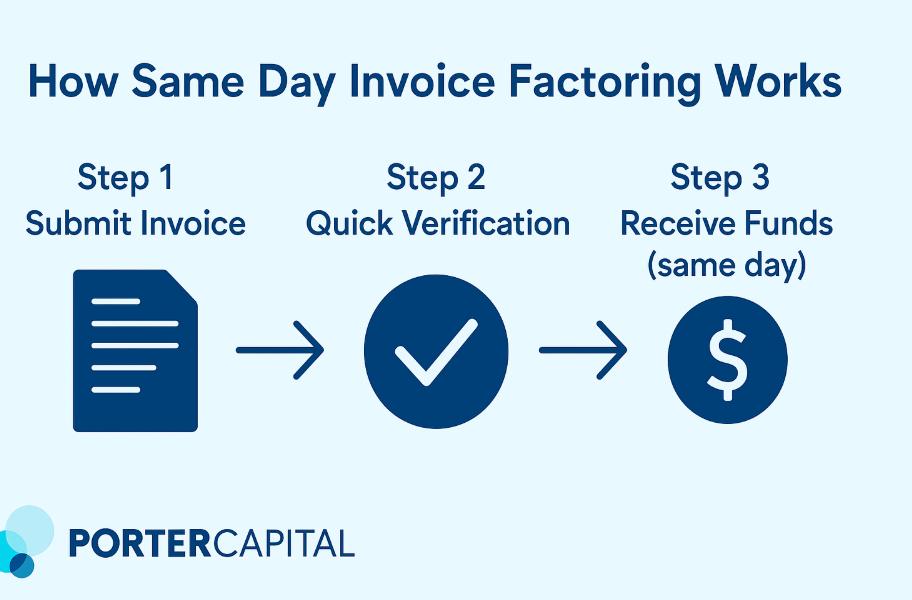

How Does Same Day Invoice Factoring Work?

The process of same day invoice factoring starts with businesses submitting invoices to a factoring company for quick cash advances. This can be done easily through a mobile app or online portal. Instead of factoring all outstanding invoices, businesses can choose to factor specific invoices.

Once the invoices are submitted, they go through a quick verification process and payments can be disbursed within an hour of approval. This fast process means you can get cash in a day, without waiting for 30, 60 or 90 day payment cycles.

Factoring companies offer advances up to 90% of the face value of an invoice, so you get a lot of financial support quickly. Submitting invoices in the morning allows you to go through the verification process and get funds by the end of the day so you can meet your financial obligations on time.

Benefits of Same Day Invoice Factoring

Same day invoice factoring has many benefits for businesses that need cash flow:

- You can turn unpaid invoices into working capital and manage operational costs.

- Quick access to money without complex financing issues is a big plus.

- It’s good for many industries.

Using this financing solution helps you get instant cash flow and cash flow operational efficiency.

Instant Cash

Instant cash is essential for businesses to function and cover operational costs and payroll. Same day invoice factoring offers:

- You can get up to 93% of an invoice’s value as an advance in a day.

- Quick access to funds.

- You can turn outstanding invoices into cash.

- Address financial shortfalls.

- Operational stability.

Service oriented businesses and manufacturers benefit from this solution by stabilizing cash flow and financing raw materials even when clients are delayed in payments.

No Debt

One of the biggest advantage of same day invoice factoring is that it’s not a loan so no debt is incurred. You don’t have to pay fees if you don’t factor any invoices.

Also, invoice factoring allows free credit checks on potential customers before you engage, so it’s risk free way to check customer reliability.

Flexible Financing

Invoice factoring is a flexible financing solution where you can finance one or multiple invoices at a time depending on your needs. This is great for businesses that have fluctuating cash flow needs as it allows you to manage your finances dynamically without the constraints of traditional business loans. Also invoice factoring is an alternative to traditional financing options. Invoice factoring is an alternative to traditional financing options.

By partnering with a reliable invoice factoring company you can get consistent cash flow and meet your financial obligations on time. Choosing the right factoring company can enhance these benefits. Factoring companies can help you with that.

Costs of Same Day Invoice Factoring

While same day invoice factoring gives you immediate financial support, you need to understand the costs involved with this service fee. Generally the costs include a discount rate, usually between 1% to 4% of the invoice value. Common fees associated with invoice financing are transaction fees, processing fees and financing fees.

Additional costs can include late fees, application fees and increased annual percentage rates which can add up if not monitored closely.

Typical Factoring Fees

Typical factoring agreements include:

- Fees ranging from 1% to 4% of the invoice value.

- Discount fees generally ranging between 2% to 20% of the invoice amount, calculated based on financing.

- An advance rate where you can get 70% to 90% of the invoice’s face value upfront including a factor fee.

You need to watch out for hidden costs such as credit check fees and monthly service charges that may not be obvious. Review the entire agreement to identify any additional charges that can impact overall expenses.

Factors that Affect Costs

The total cost of invoice factoring is affected by:

- The volume of invoices you process.

- Customer reliability which affects eligibility for factoring, advance rates and fees charged by factoring companies.

- High customer concentration where a significant portion of revenue comes from a few clients increases risk and can result to lower funding rates.

So you need to consider these factors when evaluating the costs of same day invoice factoring.

Recourse vs Non-Recourse Factoring

When considering invoice factoring you need to understand the difference between recourse and non-recourse factoring. Recourse factoring is the most common where you repurchase the invoices unpaid by the customer. Non-recourse factoring means the factoring company assumes the responsibility of collecting the payment and accepts the loss if the customer doesn’t pay.

Each has its pros and cons and affects the overall risk and cost of the factoring arrangement.

Recourse Factoring

In recourse factoring:

- If the customer doesn’t pay, you cover the invoice amount instead of the factoring company.

- This type of factoring has lower fees.

- The risk of non-payment is on you.

Non-recourse factoring has conditions, liability only shifts to the factoring company under specific circumstances. So you need to assess your customers’ creditworthiness when opting for recourse factoring to manage the financial risk effectively.

Non-Recourse Factoring

Non-recourse factoring means:

- The factoring company assumes the responsibility of collecting the payment and accepts the loss if the customer doesn’t pay.

- You are not liable for unpaid invoices in this arrangement.

- If the customer declares bankruptcy the factoring company takes the risk.

This makes non-recourse factoring a safer option for you.

Rates for non-recourse factoring are generally higher. This is because the factor takes on more risk in this arrangement. So you need to weigh the higher costs against the reduced risk when choosing non-recourse factoring.

How to Qualify for Same Day Invoice Factoring

To qualify for same day invoice factoring you need to submit all necessary paperwork on time. Generally you need to have outstanding invoices from creditworthy customers to qualify.

Once the documents are submitted the factoring company reviews them to determine eligibility before approving the funding. Qualified businesses can get cash fast if all the eligibility criteria and documentation is met.

Eligibility Requirements

Businesses that can access same day invoice factoring must have accounts receivables or open invoices. Unlike traditional financing, qualifications for invoice financing does not require business owner’s revenue, time in business, profits or personal credit history. The documents required are an aging accounts receivable report and a tax identification number for accounts receivable financing.Factoring companies evaluate customer creditworthiness to determine the credit risk associated with funding invoices. The customer’s creditworthiness is the top consideration for financing companies when evaluating a business for invoice financing.

Required Documents

To apply for same day invoice factoring you need to fill out a one page application and provide bank statements. A completed funding application and necessary documents are required to get same day invoice factoring funding.

An efficient approval and funding process requires diligence with paperwork so it’s essential to be thorough and on time with your documentation submission.

Industries That Can Use Same Day Invoice Factoring

Same day invoice factoring allows businesses to manage their cash flow by converting outstanding invoices into immediate cash. Various industries such as staffing, trucking and small B2B businesses can use same day invoice factoring to improve their financial stability.

For example a staffing agency used same day invoice factoring to get funds to cover payroll during payment delays from clients. This financing solution can be used by any industry that needs quick cash flow solutions and is versatile.

Manufacturing

Manufacturers use factoring to cover expenses related to materials and equipment while waiting for customer payments. For example a medium sized manufacturing factor company specializing in custom metalworks used invoice factoring to keep operations smooth and pay suppliers on time.

This liquidity ensures manufacturers can keep production running without interruption even during long payment cycles from customers.

Transportation

Transportation companies benefit from factoring to alleviate cash flow issues caused by long payment cycles. For example freight factoring helps transport businesses keep operations running during financial tight spots.

By using same day invoice factoring transportation companies can cover immediate expenses like fuel and vehicle maintenance so their operations run smoothly.

Service Providers

Service based businesses encounter cash flow problems due to delayed payments from slow paying clients. For example a staffing agency had cash flow problems due to payment delays from clients but used same day invoice factoring to get funds for payroll so clients can pay on time.

This solution allows service providers to cover operational costs and stay financially stable even when client payments are delayed.

Common Mistakes to Watch Out for When Using Invoice Factoring

Many businesses overlook potential pitfalls when using invoice factoring and end up with financial problems. Hidden fees in invoice factoring can increase overall cost and impact cash flow and profitability. Ignoring customer creditworthiness can result to factoring invoices from clients who may not pay and increase risk for the business.Being thorough and doing your due diligence helps businesses avoid common mistakes with invoice factoring.

Hidden Fees

A reputable factoring company will have no hidden fees. However in non-recourse factoring agreements businesses should be aware of additional charges and higher factoring fees. Hidden fees can increase overall cost of invoice factoring.

To avoid surprise costs make sure you review the fee structure before signing a factoring agreement. This will help you manage your cash flow and avoid financial surprises.

Customer Creditworthiness

Qualifying for same day invoice factoring is all about evaluating the creditworthiness of your customers not your business credit history. Customer creditworthiness and business revenue impact a business’s eligibility for invoice factoring.

Assessing customer credit history is important as it affects the likelihood of timely invoice payments and their payment history. Conducting thorough credit checks helps businesses prevent defaults and maintain cash flow.

Wrapping Up

Same day invoice factoring is a valuable tool for businesses that need quick access to cash. By converting unpaid invoices into immediate working capital businesses can manage operational costs, payroll and other expenses without waiting for delayed payments. The benefits of immediate cash flow, no debt incurred and flexible financing make it a good option across various industries. But understanding the costs, choosing between recourse and non-recourse factoring and avoiding common pitfalls like hidden fees and ignoring customer creditworthiness is key to maximizing its benefits. Using same day invoice factoring can improve cash flow and financial stability.

FAQs

What is same day invoice factoring?

Same day invoice factoring is a financing solution that converts your unpaid invoices into cash, usually within the same day. This can improve cash flow and provide immediate financial support.

How does same day invoice factoring work?

Same day invoice factoring allows you to submit your invoices to a factoring company that will provide a cash advance based on a percentage of the invoice value, usually within the same day. This will improve cash flow immediately.

What are the benefits of same day invoice factoring?

Same day invoice factoring provides immediate cash flow without incurring debt and offers flexible financing options, making it a good solution for business expenses.

What are the costs associated with same day invoice factoring?

Costs of same day invoice factoring are 1% to 4% of the invoice value and may have additional hidden fees.

Which industries use same day invoice factoring?

Manufacturing, transportation and service providers.