Overview

Invoice factoring is a financial service that allows businesses to convert outstanding invoices into immediate cash. This blog examines the latest industry data and provides valuable insights into the role and impact of invoice factoring across various sectors, its market growth, operational implications, and overall utility in promoting business efficiency.

Industry Adoption and Impact

Market Size and Growth

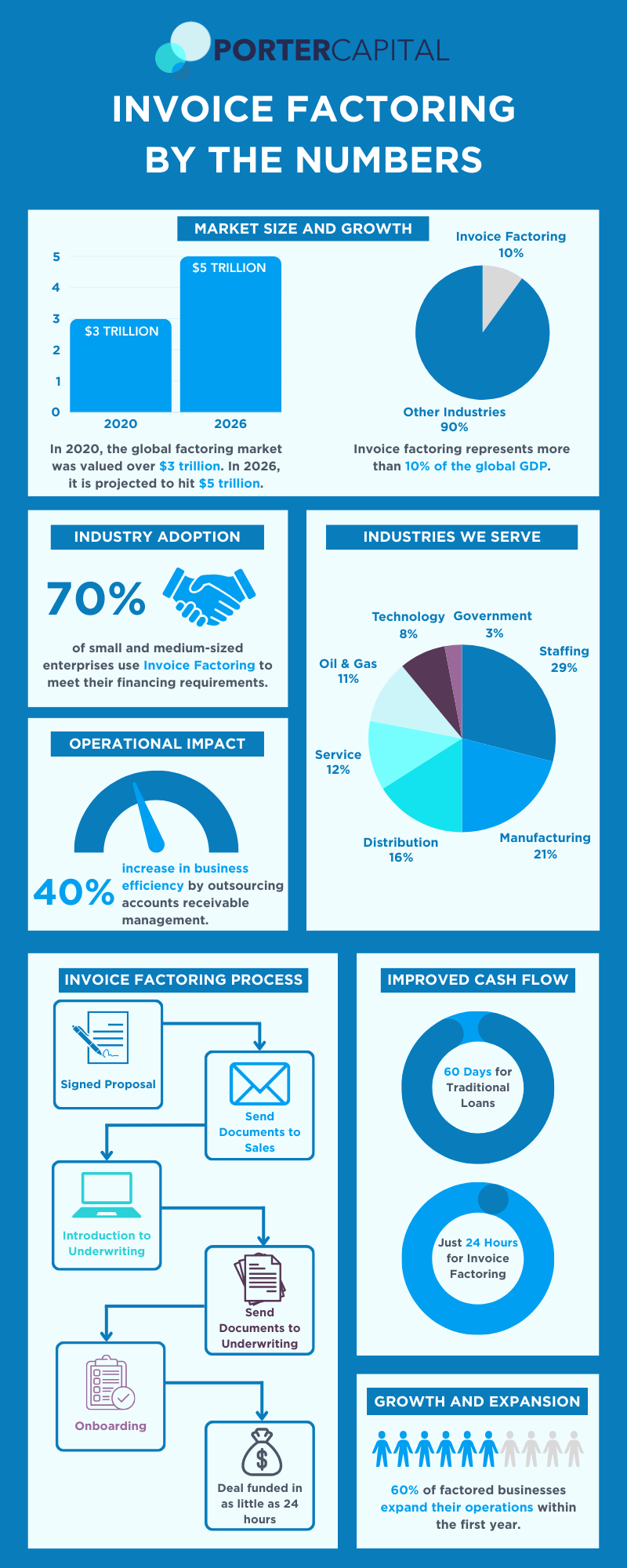

The infographic highlights significant growth in the global factoring market. In 2020, the market was valued at over $3 trillion, and it is projected to reach $5 trillion by 2026. This robust growth underscores the increasing reliance on invoice factoring as a financing tool across industries.

Industries Served

Porter Capital serves a diverse range of industries, such as:

- Staffing: 29%

- Manufacturing: 21%

- Distribution: 16%

- Service: 12%

- Oil & Gas: 11%

- Technology: 8%

- Others: 3%

This diversity indicates the widespread applicability of invoice factoring, with a significant portion of usage in staffing and manufacturing sectors, which are often capital-intensive and benefit greatly from improved cash flow.

Operational Impact

Efficiency and Financing

Invoice factoring significantly enhances business efficiency by outsourcing accounts receivable management. This service is used by 70% of small and medium-sized enterprises (SMEs) to meet their financing requirements. The infographic also notes that invoice factoring represents more than 10% of the global GDP, highlighting its importance in the global economy.

Speed of Funding

A key advantage of invoice factoring is the speed of funding. Traditional loans typically take about 60 days to process, whereas invoice factoring can provide funding in as little as 24 hours. This rapid turnaround is crucial for businesses needing immediate liquidity to maintain operations and support growth.

Porter Capital Process of Invoice Factoring

- Signed Proposal: The factoring process begins with the signing of a proposal.

- Document Submission to Sales: Necessary documents are sent to the sales team.

- Introduction to Underwriting: The client is introduced to the underwriting team.

- Document Submission to Underwriting: Underwriting review of documents.

- Onboarding: The client is onboarded.

- Funding: Deals can be funded in as little as 24 hours.

This streamlined process ensures quick access to funds, enabling businesses to maintain a steady cash flow. All steps can be completed in a matter of days and funding can be provided within 24 hours of completion.

Growth and Expansion

The infographic reveals that 60% of businesses using invoice factoring expand their operations within the first year. This expansion is facilitated by the improved cash flow and financial stability that invoice factoring provides, allowing businesses to reinvest in growth opportunities.

Wrap-Up

Invoice factoring is a vital financial tool that offers immediate liquidity, enhances operational efficiency, and supports business growth. Its adoption across various industries and its significant contribution to global GDP underscore its importance in the financial landscape. The projected growth of the factoring market indicates a continued reliance on this service, particularly among SMEs seeking efficient financing solutions.

Invoice factoring can be a valuable financial tool for businesses seeking immediate access to capital. Instead of waiting 30, 60, or even 90 days for invoice settlements, many forward-thinking companies leverage corporate factoring to accelerate cash flow and focus on growth initiatives. If you’re considering corporate factoring, contact Porter Capital to determine if your business qualifies.

Apply now for same-day financing for your company or call 1-888-865-7678 to learn more.

Sources

Global Factoring Market Size, Share & Trends Analysis Report by Category, By Region, And Segment Forecasts, 2021 – 2028: Available on Grand View Research.

SME Finance Forum Reports: Regularly publishes data on SMEs’ financing options, including factoring.

The Benefits of Factoring: Whitepaper by The Commercial Finance Association.

Invoice Factoring: A Tool for Growth: Case study available on The Factoring Place website.

Efficiency Gains from Factoring: Available from the International Factoring Association.

Impact of Factoring on Business Operations: Research articles and whitepapers from academic journals like the Journal of Business & Industrial Marketing.