Reading Time: 12.5 minutes

Last updated: May 19, 2025

Benefits of Invoice Factoring for Small Business Owners

Invoice factoring for small businesses turns unpaid invoices into immediate cash. This means cash flow without waiting for customer payments. In this article, we’ll go over how invoice factoring for small business works and its benefits for small business owners.

Key Points

- Invoice factoring lets small businesses sell their unpaid invoices to a factoring company for immediate cash, cash flow without debt.

- This financial tool is available to businesses with bad credit, as it’s based on the creditworthiness of their customers, so funding for those who can’t get traditional loans.

- Porter Capital offers competitive rates and fast access to cash, funding usually within 1-2 days, so small businesses can stay operational.

What is Invoice Factoring?

Invoice factoring is a financial transaction where a business sells its accounts receivable (unpaid invoices) to a third party, called a factoring company, at a discount for immediate cash. This is not a loan but a sale of invoices, which is different from traditional bank financing, invoice discounting, receivable financing and accounts receivable financing. Small businesses benefit from factoring invoices as it bridges the gap caused by delayed customer payments, often 30, 60 or 90 days.

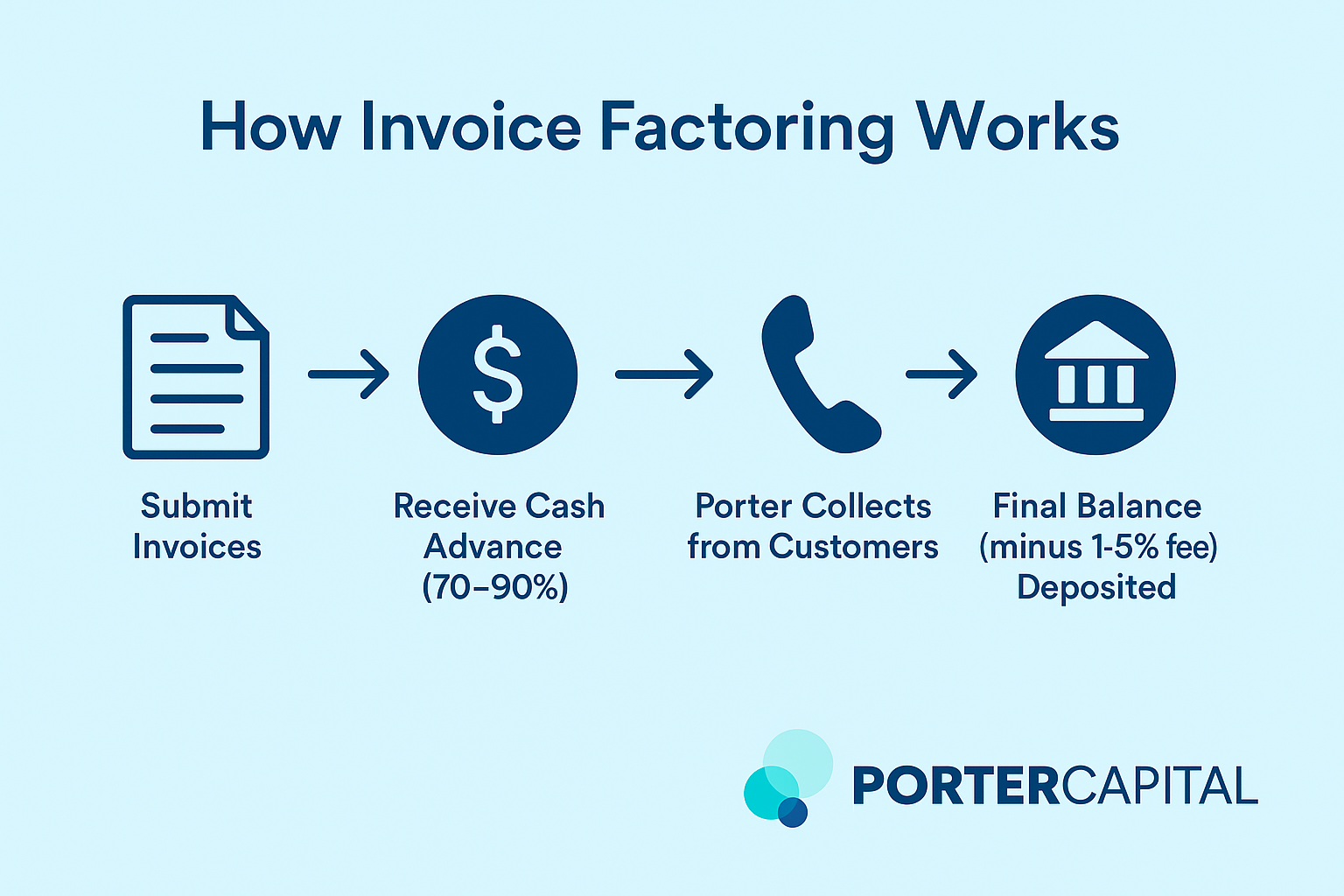

The process of invoice factoring involves several steps:

- Businesses submit their outstanding invoices to a factoring company.

- The factoring company then advances a significant portion of the invoice value, usually 70% to 90%, to the business.

- This immediate cash can be used to cover operational expenses, pay employees and invest in growth opportunities.

- The factoring company takes on the responsibility of collecting payment from the business’s customers, so the business doesn’t have to spend time chasing down unpaid invoices.

The main benefit of invoice factoring is cash flow without debt. Since it uses invoices as collateral, it doesn’t affect the business’s credit score. Small businesses which can’t qualify for traditional loans due to strict credit requirements find invoice factoring a good alternative.

Converting outstanding invoices into immediate cash allows businesses to stay liquid and focus on how to improve cash flow and operational efficiency.

How Invoice Factoring Works for Small Business?

Understanding how invoice factoring works is key for small business owners who want to use this financial tool. The process starts with signing a financing agreement with a factoring company. This agreement outlines the terms and conditions, including the factoring fees, advance rates and payment terms.

Once the agreement is in place, the business submits their outstanding invoices to the factoring company. This step is easy and involves providing basic information about the business and the quality of the unpaid invoices. The factoring company then reviews the invoices and advances a percentage of their value to the business, giving immediate cash flow.

The final step is the collection of payments from the business’s customers. The factoring company takes on the responsibility of collecting these payments, deducts a service fee and transfers the remaining balance to the business. This way small businesses can have steady cash flow without the hassle of managing collections especially when the customer pays.

Let’s go deeper into each step of this process below.

Submit Invoices to Porter Capital

Submitting invoices to Porter is a streamlined process designed to get you funded. Initially, businesses must submit a request to submit their invoices to their customers before they can submit their invoices. This ensures the invoices are legitimate and ready for factoring.

Porter Capital accepts all types of invoices from small businesses so it’s a flexible option for various industries. However, invoices from customers who have explicitly stated they cannot pay are not eligible for factoring.

The application process is quick and can be done in just a few minutes so businesses can get started with factoring right away.

Get Cash Advances

Once the invoices are submitted, businesses can expect to get a cash advance from Porter Capital. Typically, the advance is 70% to 90% of the invoice value depending on the factoring company’s policy. This immediate cash is crucial to run the business and cover any cash flow gaps.

The speed of getting cash advances is one of the biggest benefits of invoice factoring. Most businesses can get funded within 1-2 days after submitting their invoices. This is in contrast to traditional bank loans which can take weeks or even months to process.

Collection and Final Payment

After advancing the cash, the factoring company takes on the responsibility of collecting payments from the business’s customers. If any issues arise during the collection process, the factoring company will contact the customers to resolve them. This takes the burden off the business of chasing payments.

Once the factoring company collects the invoice payments, they deduct a service fee, usually 1% to 5% of the invoice amount. The remaining balance is then deposited into the business’s bank account. This final payment ensures the business gets the full value of the invoice minus the factoring fees.

Benefits of Invoice Factoring for Small Business

Invoice factoring has several benefits that can impact a small business’s financial health. One of the biggest advantages is the immediate cash flow. Converting unpaid invoices into cash allows businesses to pay operational expenses, pay employees and invest in growth opportunities without waiting for customer payments.

Another key benefit is that invoice factoring is an alternative financing option for businesses that can’t qualify for traditional loans due to credit issues. Factoring companies handle the collections process which reduces the administrative burden on business owners and allows them to focus on other important aspects of their business.

Let’s dive deeper into two specific benefits: qualify despite bad credit and maintain business equity.

Qualify Despite Bad Credit

Small business owners with bad credit can still qualify for small business invoice factoring making it a good alternative financing option for a small business owner. The approval process focuses on the creditworthiness of the business’s customers rather than the business credit itself. This means even if a business owner has a poor credit history they can still get funded as long as their customers have good credit, including small business factoring and a business loan.

Many factoring companies have low or no minimum credit score requirements which makes this financing option more accessible. Factoring companies also handle credit checks and collections so business owners can focus on growing their business without worrying about credit check fees.

Maintain Business Equity

One of the biggest benefits of invoice factoring is that businesses can get funded without sacrificing equity or assets. Unlike traditional loans which may require collateral or ownership stakes, invoice factoring uses the business’s accounts receivable as collateral. This means business owners can maintain full ownership and control of their company. Porter Capital has financial tools to help small businesses manage their cash flow, reduce financial risk and support business growth through proprietary account management software. By having a healthy business cash flow and addressing potential cash flow issues businesses can preserve their equity and continue to invest in their business without jeopardizing their financial stability.

Choosing the Right Factoring Company

Choosing the right factoring company is key for small businesses looking to improve their cash flow through invoice factoring. Look for companies with experience in your industry as this can impact the level of service and understanding of your business needs. Shop around and compare different factoring companies to find the best factoring company for your business.

When selecting a factoring company prioritize top-rated companies on review sites and those backed by a bank for added credibility. Review the factoring agreement thoroughly to understand all fees and terms of the service. This will avoid unexpected costs and ensure you know all the factoring fees involved.

Consult with a financial advisor to get more insights and make informed decisions on factoring agreements. By choosing a reputable factoring company small businesses can improve their cash flow and focus on growth and operational efficiency.

Types of Invoice Factoring Offered by Porter Capital

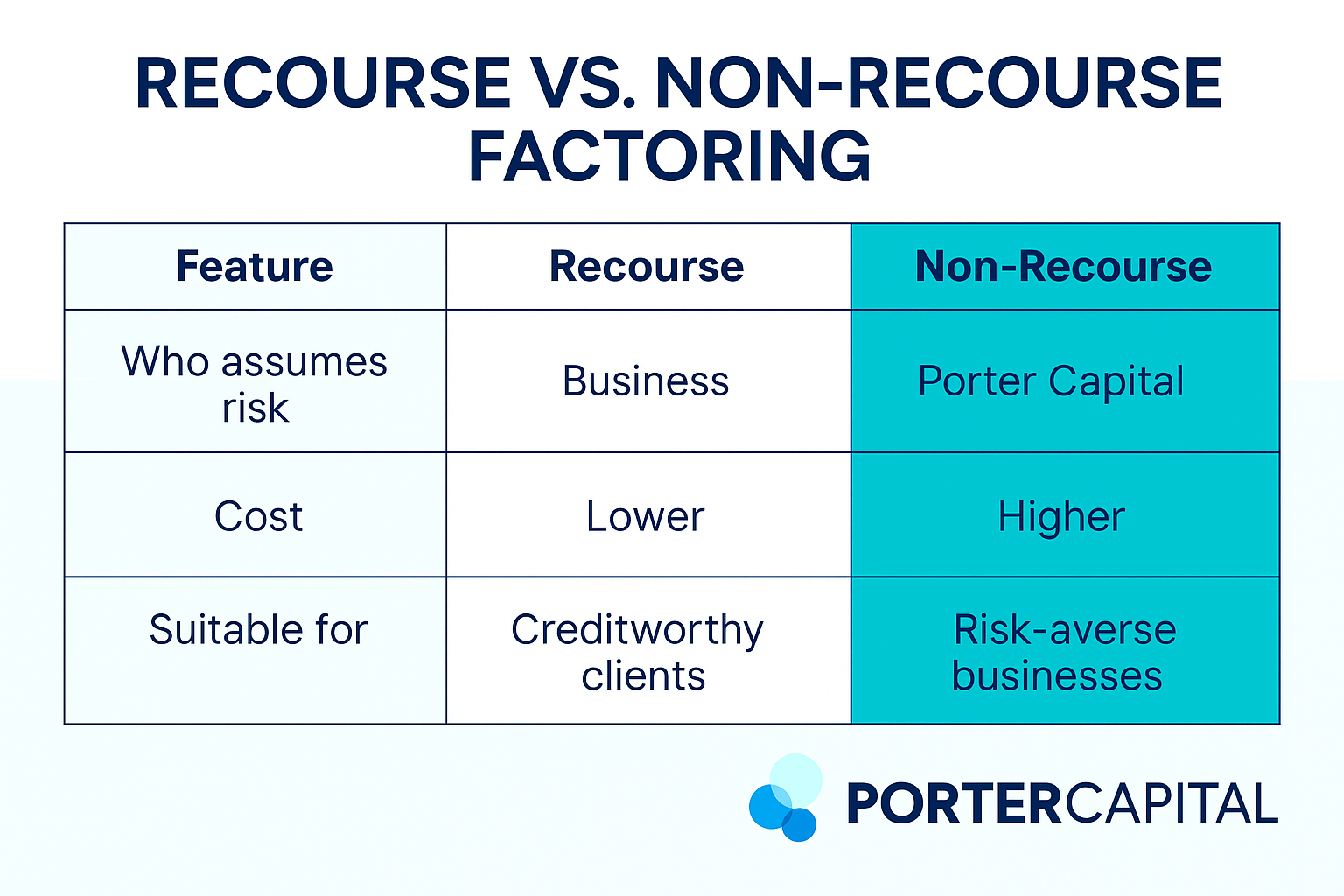

Porter Capital offers different types of invoice factoring to suit small businesses. The main types are recourse and non-recourse factoring, each with its own benefits and considerations. Both provide immediate cash flow by selling outstanding invoices to a factoring company at a discount.

Recourse factoring means the business is liable for unpaid invoices, if the customers don’t pay the business must repay the cash advance. Non-recourse factoring transfers the risk of non-payment to the factoring company, protecting the business from financial loss.

Let’s go into the details of recourse and non-recourse factoring.

Recourse Factoring

Recourse factoring is a type of invoice factoring where the business remains liable for any unpaid invoices. This means if the customers don’t pay their invoices the business must repay the cash advance to the factoring company. This type of factoring has lower fees compared to non-recourse factoring but it also puts more risk on the business.Businesses choosing recourse factoring must assess their customers’ creditworthiness to mitigate the risk of non-payment and maintain good customer relationships. Despite the added responsibility recourse factoring can be a cost effective solution for businesses with good customers.

Non-Recourse Factoring

Non-recourse factoring means the factoring company assumes the risk of non-payment. In this arrangement if the customers don’t pay their invoices the factoring company absorbs the loss. This type of factoring offers more protection for the business but usually comes with higher factoring fees as the factoring company takes on more risk.

Non-recourse factoring is ideal for businesses that want to minimize their financial risk and have stable cash flow even if some customers don’t pay their invoices. This option gives peace of mind and allows businesses to focus on growth without worrying about unpaid invoices through non recourse invoice factoring.

Industries That Use Invoice Factoring

Invoice factoring is a versatile financial tool that benefits various industries by providing quick access to funds and cash flow management through an invoice factoring service, invoice factoring company, factor invoices, factoring service, factoring services, factored invoices, and invoice factoring companies.

Industries that use invoice factoring include:

- Manufacturing

- Staffing agencies

- Healthcare

- Transportation

These sectors use invoice factoring to meet their immediate financial needs.

Manufacturing businesses get up to 80% of the invoice value upfront and can pay workers and fulfill more orders. During the COVID pandemic staffing agencies used invoice factoring to get cash fast and recruit more temporary workers to meet the surge in demand.

Healthcare providers can settle costs for supplies and equipment while waiting for insurance payments and transportation companies can pay for fuel and payroll while waiting for payments. By providing quick access to funds invoice factoring helps businesses in these sectors avoid long approval processes and keep operations running.

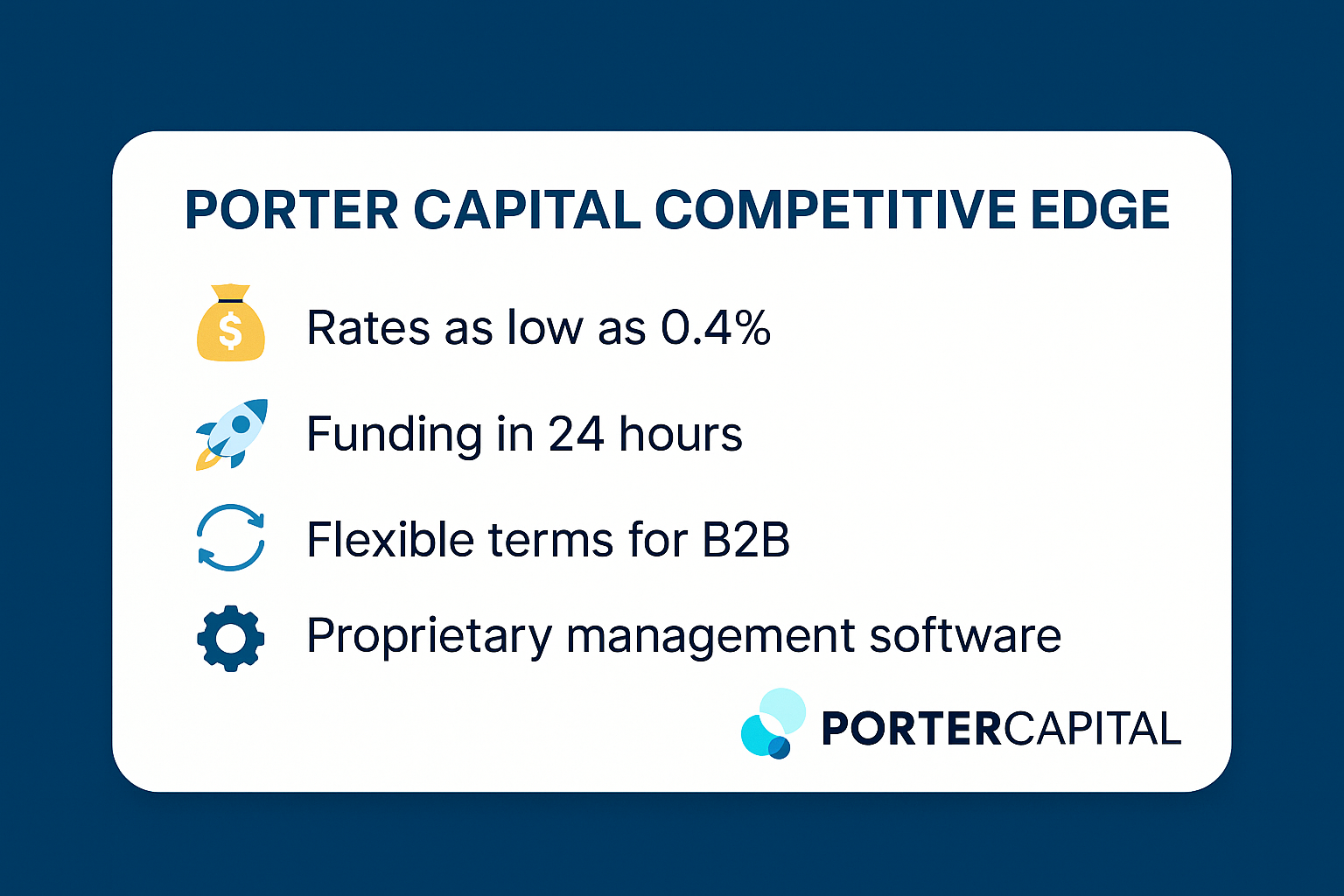

Porter Capital’s Competitive Edge

Porter Capital stands out in the invoice factoring industry by offering the lowest rates and fastest, most flexible financing solutions for B2B businesses. Businesses can get funded in as little as 24 hours which is critical for smooth operations and urgent financial needs. This fast turnaround time is what sets Porter Capital apart from traditional financing options which have long approval processes. Also, Porter Capital offers flexible business financing options for businesses that don’t qualify for traditional financing. This flexibility means businesses of all sizes and credit profiles can use invoice factoring and maintain cash flow and focus on growth.

How Much Does Invoice Factoring Cost?

Invoice factoring costs range from 1% to 5% of the total invoice value. Porter Capital offers rates as low as 0.4% making it a cost effective way to get cash flow without breaking the bank. Factors such as monthly receivables volume and average invoice size affect the rates offered.

In non-recourse factoring where the factoring company assumes the risk of non-payment the fees are higher due to the increased risk including potential hidden fees and additional fees. Recourse factoring has lower fees as the business is liable for unpaid invoices. Volume discounts are also provided by factoring companies meaning higher amounts factored usually means lower fees.

Understanding these costs and how they are calculated is important for businesses considering invoice factoring. By reviewing the factoring agreement and discussing fee structures with the factoring company businesses can make informed decisions that suit their financial needs.

How to Get Started with Invoice Factoring

Getting started with invoice factoring is a simple process. Businesses need to provide specific documents including information about their operations and the invoices to be factored. Startups also need to meet requirements for time in business and annual revenue to qualify for invoice factoring. The application process takes over a week due to the thorough evaluations but the funding can be secured within 24 hours once approved.

The amount received from a factoring company is usually 80% of the invoice value which is established during the agreement process. Once signed with a factoring company a ‘notice of assignment’ may be sent to your clients informing them of the new payment instructions. This ensures payments are directed to the factoring company for collection.

By understanding the requirements and process businesses can get funded fast and efficiently through invoice factoring and get cash flow and business growth.Invoice factoring is a solution for small businesses with cash flow issues. By turning unpaid invoices into immediate cash businesses can stay liquid, cover operational expenses and invest in growth opportunities. The process involves submitting invoices, receiving cash advances and allowing the factoring company to collect, which takes the burden off businesses to chase payments.

Porter Capital offers competitive rates, fast funding and flexible funding options, making it a great choice for businesses looking for invoice factoring services. By choosing the right factoring company and understanding the costs businesses can use invoice factoring to maintain cash flow, preserve equity and focus on growth. Get to know the power of invoice factoring and unlock new opportunities for your business’s financial health and success.

FAQs

What is invoice factoring?

Invoice factoring is selling unpaid invoices to a factoring company at a discount to get immediate cash flow. This can greatly improve your liquidity and manage business expenses better.

How fast can businesses get funded from Porter Capital?

Businesses can get funded from Porter Capital in as little as 24 hours.

What are the costs associated with invoice factoring?

Invoice factoring costs range from 1% to 5% of the total invoice value, with rates as low as 0.4%. Understanding these fees can help you make informed decisions.

Can businesses with bad credit qualify for invoice factoring?

Yes, businesses with bad credit can qualify for invoice factoring since the focus is on the creditworthiness of their customers not their own credit score. This makes it a viable financing option for those who need it.

What industries use invoice factoring?

Invoice factoring is ideal for industries like manufacturing, staffing, healthcare and transportation as it provides quick access to funds and cash flow management.