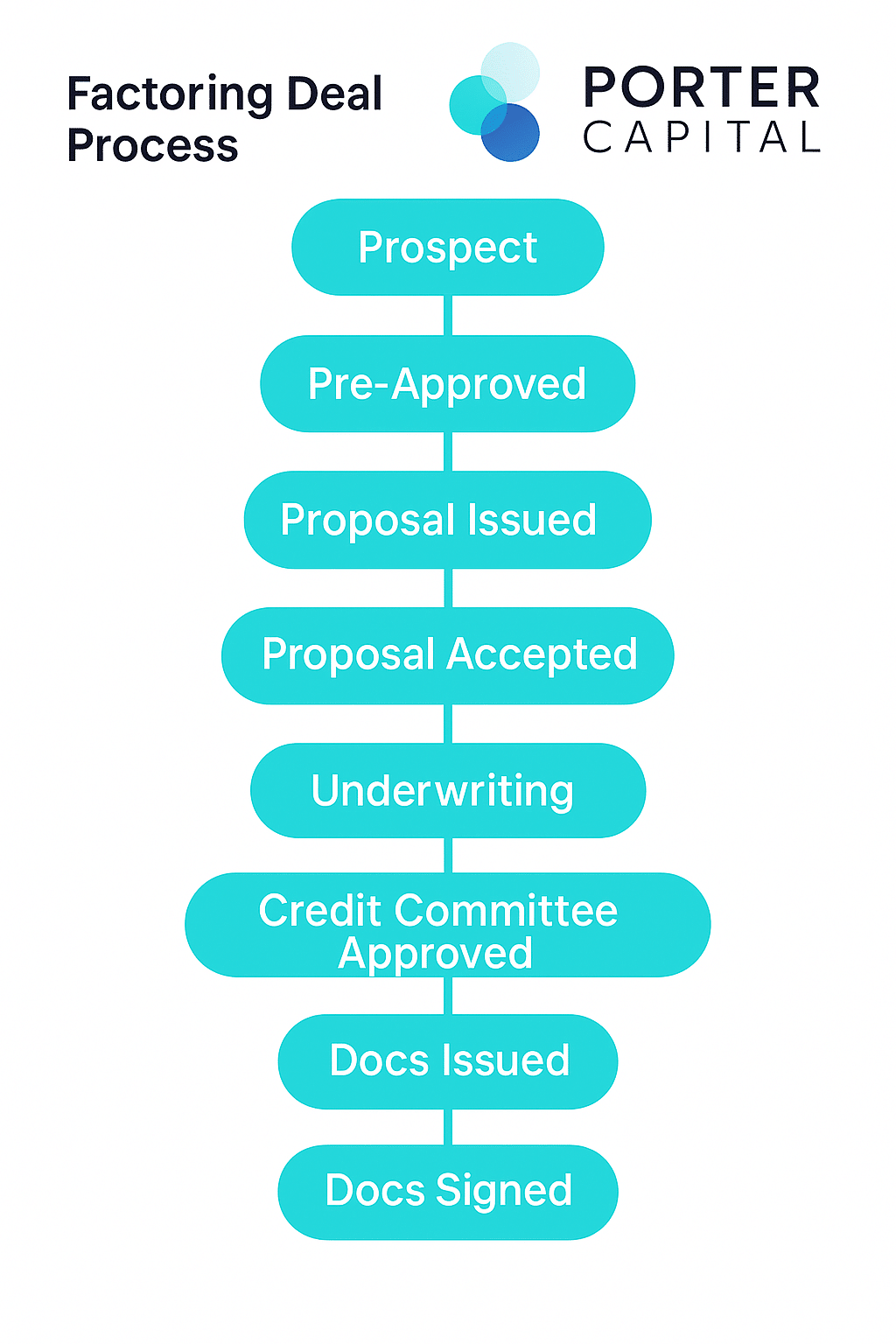

How Our Factoring Process Works

At Porter Capital, we believe accessing capital shouldn’t be complicated. Our streamlined factoring process is designed to help businesses like yours turn unpaid invoices into immediate cash—without the red tape. Whether you’re scaling fast or facing a cash crunch, our expert team will guide you from first contact to funded in just a few simple steps.

The Factoring Journey

🟢 Prospect

You reach out to us, or we connect with you. At this stage, we’re just getting to know each other. We’ll ask some basic questions about your business, how you invoice, and the types of customers you serve. If you’re a B2B company that sells on terms, you’re already off to a great start.

✅ Pre-Approved

Based on your answers and quick research, we determine if you meet our initial requirements. This includes:

- Selling to other businesses (not consumers)

- Invoicing after delivery of a product/service

- Unencumbered receivables

- Monthly invoice volume that makes factoring efficient (usually $25K+)

This stage is all about ensuring a good fit before we dive deeper.

📄 Proposal Issued

Once you’re pre-approved, we send over a proposal that outlines the key details of our offer:

- Advance Rate (usually around 85–90%)

- Fee Structure (our discount rate based on time outstanding)

- Terms and services included (like online dashboard access and credit checks)

This proposal is not a contract—it’s simply a clear, written offer so you know what to expect.

🖊️ Proposal Accepted

If you like what you see, you give us the green light to proceed. This stage signals serious intent, and we begin collecting more detailed documents for underwriting. You’re not locked in yet, but we start preparing for a deeper evaluation.

🔍 Underwriting

Our credit and risk teams take a thorough look at your business. This includes:

- Analyzing your accounts receivable aging report

- Reviewing sample invoices and backup documents

- Evaluating your customers’ creditworthiness

- Checking for tax liens, bankruptcies, or legal encumbrances

We also verify invoices using methods like verbal confirmation or reviewing proof of delivery.

🏛️ Credit Committee Approved

Once underwriting is complete, your deal is presented to our internal credit committee. If approved, this means we’re confident in your customers’ ability to pay—and we’re ready to move forward.

This is the final green light before paperwork.

📑 Docs Issued

We send you the official agreement to review and sign. This includes:

- The factoring agreement

- Any necessary UCC filings

- Details about your lockbox address or remit-to info

You’ll also get a breakdown of how the process will work day-to-day.

✍️ Docs Signed

You sign the agreement, and your client relationship officially begins. We start preparing your customer notifications and setting you up in our system.

🚀 Onboarding

We notify your customers (account debtors) with a Notice of Assignment, instructing them to send payments to your new lockbox. We also train you or your team on:

- Submitting invoices

- Tracking advances and rebates in our portal

- Asking for credit checks on new customers

Once onboarding is complete, you’re ready to start submitting invoices and receiving funding—often within 24 hours.

What You Get With Porter Capital

✔️ Advances up to 90% of your invoice value

✔️ Funding in as little as 24 hours

✔️ Dedicated account manager

✔️ Full credit checks on new and existing customers

✔️ Online dashboard with real-time tracking

✔️ Support from experienced professionals in receivables management

Industries We Serve

We specialize in working with B2B businesses across a range of sectors:

- 📦 Distribution & Wholesale

- 🚚 Trucking & Transportation

- 🧼 Janitorial & Security Services

- 🏭 Manufacturing

- 👥 Staffing & Temp Agencies

- 🏥 Healthcare Vendors

… and more!

👉 [See If You Qualify]

What Our Clients Say

“Porter helped us make payroll when our biggest client delayed payment 45 days. Couldn’t run my business without them.”

— CEO, Staffing Agency

“They’re fast, easy to work with, and got us through a tight cash cycle without jumping through hoops.”

— CFO, Regional Distributor

Frequently Asked Questions

How long does the process take?

From proposal to funding, it can take as little as 3–5 business days depending on your responsiveness.

Do I have to factor every invoice?

Nope. We offer flexibility. You choose which invoices to submit.

What if my customers are slow to pay?

We monitor receivables and handle follow-ups professionally. You’ll still receive the advance, and we’ll manage the collection.

Is this a loan?

No. Factoring is the sale of your receivables—not debt. No repayments or interest involved.