Top Factoring Companies for Cash Flow Solutions

Business lending companies, including factoring companies, help businesses manage cash flow by buying unpaid invoices and turning them into cash. This article will cover top factoring companies and how they can help with cash flow solutions for your business.

Takeaways

- Factoring companies provide cash flow solutions by buying unpaid invoices so businesses don’t experience cash flow disruptions and can keep operating.

- Services offered by factoring companies include invoice factoring, accounts receivable financing and freight factoring, each tailored to meet specific business financial needs.

- Choosing the right factoring company involves looking at fee structures, industry experience and customer service to align with business financial goals.

- Understanding your business model is key when choosing a factoring company, as industry experience can make the factoring process smoother.

What is Factoring

Factoring is a financial solution that allows businesses to turn their unpaid invoices into cash. This process is also known as invoice factoring. It allows companies to improve cash flow and reduce bad debt. By working with a reputable factoring company, businesses can get a large portion of the invoice value upfront, usually within 24 hours. This cash can be used to pay employees, buy supplies or invest in growth opportunities.

Factoring is perfect for businesses with cash flow issues due to slow paying customers. Instead of waiting for customers to pay their invoices, businesses can sell those invoices to a factoring company and get cash immediately. This financial solution helps businesses maintain steady cash flow so they can cover expenses and take advantage of new opportunities without financial strain. By working with a reputable factoring company, businesses can get the cash they need to thrive and grow.

What are Financial Factoring Companies

Financial factoring companies are the behind the scenes heroes of business finance. They buy unpaid invoices at a discount and give businesses cash to keep operating without interruption. This service is not limited to a specific industry or business size; from trucking to healthcare and from small startups to large enterprises, any business can benefit from the financial solutions offered by factoring companies. Factoring companies provide financial solutions that help business owners navigate cash flow challenges and grow their business. One of the biggest benefits of working with a factoring company is the speed of cash. Once approved, businesses can get funds within 24 to 48 hours, reducing the financial strain of waiting for clients to pay. Typically a business gets 85% of the invoice amount upfront and the remaining balance minus fees when the client pays. This quick turnaround is crucial for cash flow in industries where payments are delayed, so businesses can get paid faster.

For businesses with cash flow issues, factoring is a practical solution. Factoring companies finance against unpaid invoices so businesses can manage slow paying clients and stay financially stable. This immediate cash flow can be the difference between stagnation and growth, making factoring an essential tool for businesses looking for long term success.

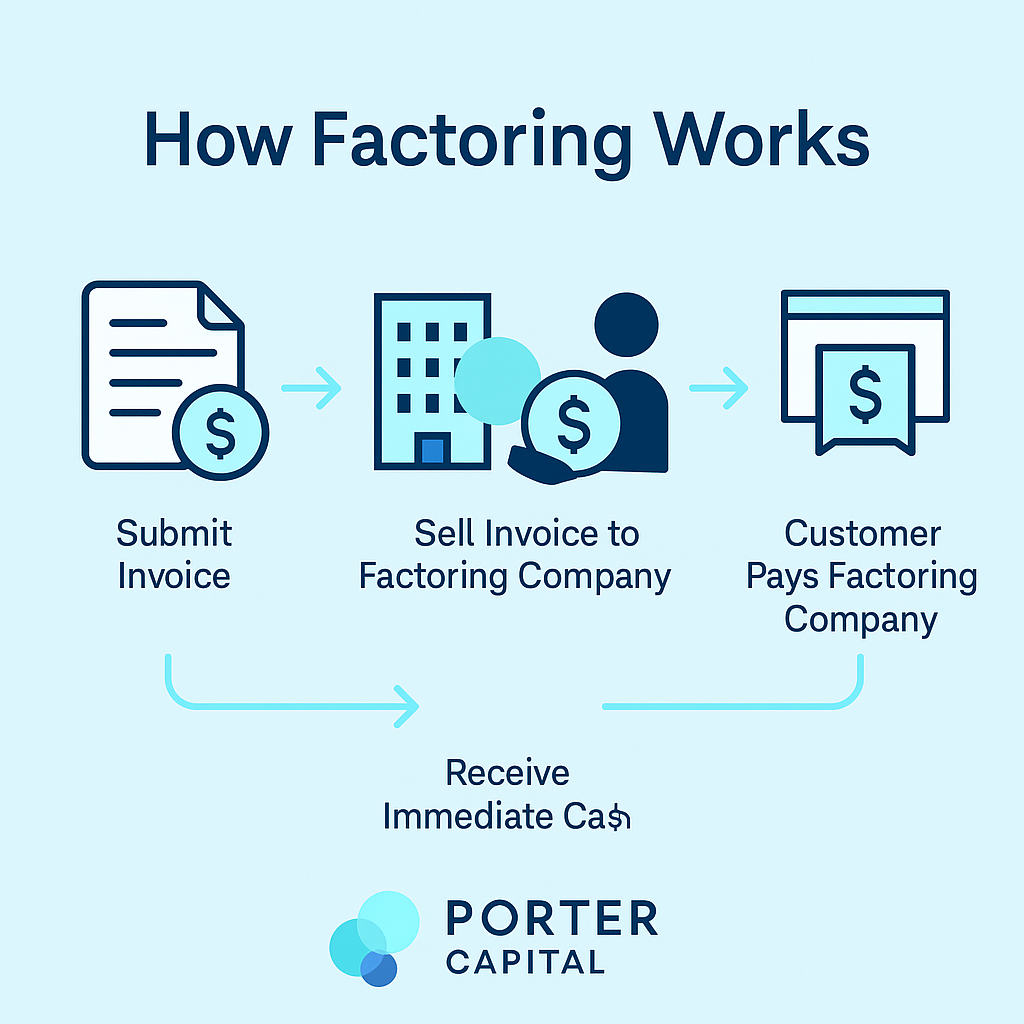

How Factoring Works

The factoring process involves a factoring company buying a business’s outstanding invoices at a discount. The factoring company then collects from the customers and the business gets the remaining balance minus a factoring fee. This fee is usually a percentage of the total invoice amount and varies by factoring company and industry.

For example a business with $100,000 in outstanding invoices might get $80,000 from the factoring company upfront. Once the customers pay their invoices the business gets the remaining $20,000 minus the factoring fee. This provides businesses with immediate cash flow to meet their financial obligations and invest in growth opportunities.

The factoring process is simple and involves minimal paperwork. Businesses submit their invoices to the factoring company which then verifies the invoices and advances a percentage of the invoice value. Once the customers pay the factoring company releases the remaining balance to the business minus the agreed upon fees. This process allows businesses to get cash fast so they can operate and grow.

Services Offered by Factoring Companies

Factoring companies offer a range of services to improve cash flow and financial stability. These services include invoice factoring, accounts receivable financing and freight factoring. Each service is tailored to meet specific business needs so businesses can manage their finances with an invoice factoring company. Factoring companies often have minimum requirements such as a certain period of operation and average monthly revenue that businesses must meet to qualify for their services.Factoring companies provide immediate cash flow to meet cash flow by buying outstanding invoices so businesses can operate and grow.

Invoice Factoring

Invoice factoring is a powerful tool for businesses. It helps them manage their finances while they wait for customer payments for invoices. This invoice factoring service involves buying accounts receivable, turning unpaid invoices into immediate cash flow. Invoice factoring gives businesses quick access to working capital so they can operate without the burden of delayed payments. Some factoring companies like Riviera Finance don’t require clients to meet monthly minimums so businesses have more flexibility.

One of the biggest benefits of invoice factoring is that it helps businesses with slow paying customers get cash before those customers pay. This immediate cash flow means businesses can continue to operate, invest in growth opportunities and avoid cash flow problems. Unlike traditional loans which require credit history and debt, invoice factoring provides financial solutions without those constraints so it’s an option for businesses of all sizes.

The factoring process involves advancing a percentage of the invoice values usually between 70% and 90% to the business. Once the customer pays the invoice the factoring company provides the remaining balance minus fees. Essential documentation for this process includes bank statements, factored invoices for factoring and proof of delivery or service. This simple process allows businesses to submit invoices and get cash fast.

Working with a reputable factoring company allows businesses to focus on growth and operational efficiency without the worry of slow paying customers. Invoice factoring is a cash flow solution that supports business stability and growth with an invoice factoring partner.

Accounts Receivable Financing

Accounts receivable financing is another service offered by factoring companies where businesses can get funds based on outstanding invoices through invoice financing. This method helps businesses manage their cash flow by providing immediate capital while waiting for customers to pay. The process involves submitting an accounts receivable aging report which details outstanding invoices and helps factoring providers evaluate the quality and associated risks.

Flexible payment terms can make a big difference in cash flow management so businesses can maintain customer satisfaction while operating smoothly.

This financial solution is ideal for businesses with long billing cycles or seasonal fluctuations in revenue. Converting accounts receivable into cash allows businesses to meet their cash flow needs without incurring additional debt so they can operate and be financially stable while collecting payment.

Freight Factoring

Freight factoring is a specialized service for the trucking industry so trucking companies can get paid quickly and improve cash flow. This service provides immediate funds so trucking businesses can pay for fuel, maintenance and payroll without delay. For trucking businesses timely payments are critical to avoid operational stress and smooth payroll processes.

RTS Financial offers a fuel cards and factoring program specifically for trucking businesses to manage cash flow and operational costs. By working with a factoring company that understands the trucking industry’s unique challenges businesses can achieve financial stability and focus on their core operations.

Types of Financing

There are various types of financing options for businesses each catering to different financial needs. Invoice factoring is a popular choice for businesses with slow paying customers as it provides immediate cash flow and reduces the risk of bad debt. By turning unpaid invoices into cash businesses can maintain steady cash flow and focus on growth.

Accounts receivable financing is another option where businesses use their outstanding invoices as collateral to secure a loan. This method provides immediate capital while waiting for customers to pay so businesses can manage their cash flow effectively.

Freight factoring is for trucking companies providing quick access to cash for fuel, maintenance and other expenses. This type of financing ensures trucking companies can operate without financial stress even with slow paying customers.

Equipment financing allows businesses to purchase or lease equipment while preserving their working capital. This option is ideal for businesses looking to expand or upgrade their equipment without depleting their cash reserves.

Each of these financing options has its benefits so businesses can choose the solution that best fits their financial needs and growth.

How to Choose the Right Factoring Company for Your Business

Choosing the right factoring company is critical to get the best financial results for your business. Factoring fees range from 1% to 5% of the invoice value depending on industry risk and customer creditworthiness. So it’s important to assess the entire fee structure including hidden fees not just the rates to find the right factoring partner.Industry experience is another important factor to consider. Established factoring companies have a deep understanding of the cash flow patterns of different industries so are valuable partners for your business. Researching a factoring company’s integrity and reputation is also important as working with reputable partners protects your business interests. Many factoring companies also have a referral program where they pay commissions to partners who bring in new clients which can be a win-win.

When choosing a factoring company it’s important to understand the difference between recourse and non-recourse factoring. Recourse factoring means your business is liable if a customer doesn’t pay while non-recourse factoring shifts the risk to the factoring company. Companies that offer flexible and customizable funding solutions are more likely to meet your business needs.

The quality of customer service provided by a factoring company can impact your business’s reputation so is a critical consideration in your decision making process. A systematic evaluation process including research and comparison of multiple options, terms and fees will help you choose the right factoring partner for your business. Choose wisely and you’ll get a valuable partner that supports your financial goals and business growth.

Top Financial Factoring Companies 2025

As we move into 2025 several factoring companies stand out for their service and tailored financial solutions. These top companies are:

- Porter Capital

- FundThrough

- RTS Financial

- ECapital

- Riviera Finance

Each of these small and large companies has its advantages from quick funding and competitive rates to specialized programs for specific industries.

Researching these top factoring companies helps medium sized businesses find the best factoring company to meet their financial needs and growth.

Porter Capital

Porter Capital is known for fast, flexible financing and invoice factoring services for B2B businesses. With over 30 years of experience Porter Capital offers a range of services including invoice factoring and accounts receivable financing to support businesses during growth, expansion or tough times. Their asset based lending options improve cash flow with funding options from $25,000 to $25 million.

One of Porter Capital’s strengths is their quick funding process with businesses able to get funds in as little as 24 hours. Factoring rates can be as low as 0.4% so their services are very competitive. Porter Capital supports staffing, manufacturing, distribution and service companies so is a good fit for businesses of all sizes. Clients describe Porter Capital as excellent, easy to work with and good for their business growth.

FundThrough

FundThrough is for businesses that factor invoices using accounting or invoicing software providing seamless integration and quick access to funds. This integration allows businesses to manage their cash flow efficiently, address cash flow issues and get immediate cash flow solutions.

RTS Financial

RTS Financial specializes in the trucking industry and has programs tailored to the industry’s needs. This specialization makes RTS Financial a good fit for trucking businesses, providing financial solutions to improve cash flow and operational efficiency. With RTS Financial businesses can get capital in 24 hours so they can pay expenses and keep operations running smoothly.

ECapital

ECapital offers fast and flexible invoice factoring for small businesses providing working capital to support growth and operations. Businesses can get funds as fast as the same day after submitting an invoice so they can pay expenses and seize opportunities without delay.

Riviera Finance

Riviera Finance is a non-recourse invoice factoring company, absorbing the risk if a customer doesn’t pay. This means businesses have peace of mind knowing their cash flow is protected even if clients don’t pay. Riviera Finance funds quickly, often within 24 hours so businesses can keep operations running smoothly and financially stable.

Benefits of Factoring Companies

Working with factoring companies has many benefits that can improve a business’s financial health. One of the main advantages is the immediate cash flow, factoring companies buy accounts receivable and give businesses quick access to funds. This immediate capital can be used to pay operational costs, invest in growth opportunities and maintain financial stability. Factoring companies are an alternative to traditional financing, immediate cash flow solutions without collateral or a good credit score.

Factoring can also help businesses manage risk through non-recourse factoring where the factoring company assumes the risk of non-payment. This means businesses can get funding without adding debt to their balance sheet as the payment obligation is transferred to the factoring company. Plus the qualification process for factoring is simple, it’s based on the creditworthiness of the clients not the business itself so it’s available to many businesses.

Factoring is flexible and scalable so it’s a good funding option for growing businesses. As sales increase so does the available capital so businesses can get more funds as needed. This means businesses can keep growing and expanding without being hindered by cash flow issues, making business financing a viable solution.

Alternative to Traditional Lending

Factoring is an alternative to traditional lending for many businesses, especially those with cash flow issues or limited credit history. Unlike traditional loans factoring doesn’t require a long application process, collateral or a good credit score. This makes it an accessible and flexible financing option for businesses of all sizes.

Factoring companies have more flexible terms and no hidden fees so it’s a more transparent and predictable financing option. Businesses can get immediate cash flow by selling their unpaid invoices so they can pay their bills and invest in growth opportunities without taking on more debt.For small businesses factoring can be a valuable partner in managing cash flow and growth. By providing immediate access to funds factoring helps businesses keep operations running, take on new business and achieve long term success.

Cash Flow Management

Cash flow management is key to businesses thriving and factoring can play a big part in this. By converting unpaid invoices into immediate cash businesses can pay their bills, invest in growth opportunities and maintain a steady cash flow.

This immediate cash flow allows companies to take on new customers, expand their operations and improve their overall financial stability. With the help of a reputable factoring company businesses can overcome cash flow challenges and achieve long term success.

Factoring gives businesses the financial flexibility to manage their cash flow. By partnering with a reputable factoring company businesses can get the cash flow they need to keep operations running, invest in growth and achieve their financial goals.

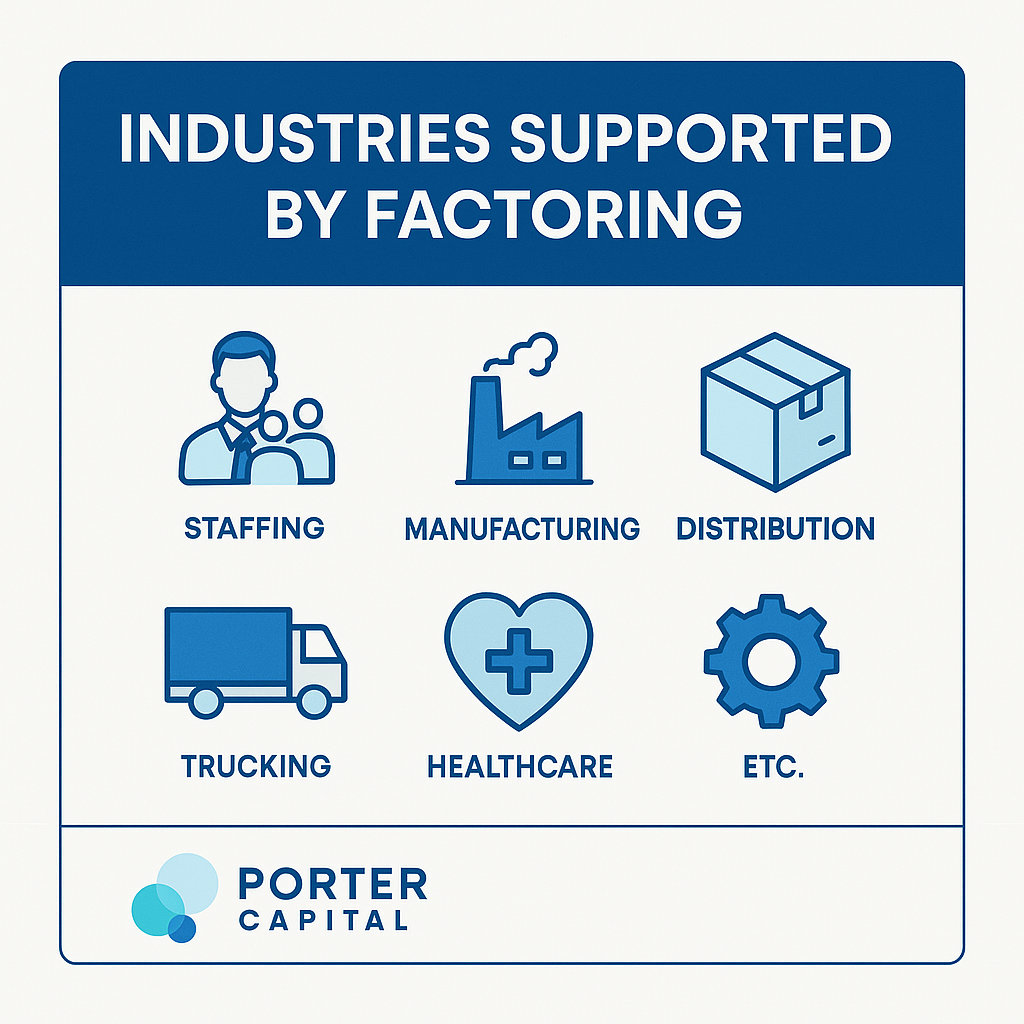

Industries Supported by Factoring Companies

Factoring companies support many industries, offering tailored solutions to meet specific financial needs. They cater to startups and large enterprises, providing cash flow solutions that facilitate growth and stability. By working with factoring companies businesses in various sectors can manage their finances and focus on their core operations.

Staffing and Payroll

Factoring companies help staffing agencies with timely payroll, so they can maintain employee satisfaction and retain talent. Immediate funding from factoring helps staffing agencies avoid cash flow disruptions and pay their bills on time. This is especially useful for industries with long billing cycles as it means employees get paid on time regardless of when clients pay their invoices.

The minimal paperwork and quick funding process of factoring makes it an efficient solution for staffing agencies. Partnering with a reputable factoring company allows these agencies to focus on their core operations and growth, knowing their payroll needs are taken care of. Discover the top staffing strategies agencies use to adapt to today’s evolving workforce demands. Explore flexible staffing solutions to find the best fit for your business.

Manufacturing

Manufacturers face cash flow challenges due to the need to purchase materials and manage operational costs. Factoring is a practical solution by converting accounts receivable into cash, so manufacturers can maintain inventory levels and keep production running without delays. This means manufacturers can focus on their core operations and growth without being hindered by cash flow issues.

Partnering with a factoring company gives manufacturers the cash flow they need to grow and manage their finances. This financial support is critical to maintaining inventory levels and keeping operations smooth especially during periods of rapid growth or increased demand.

Distribution

Distribution companies use factoring to get cash flow during peak periods so they can handle increased demand and manage inventory. Quick access to funds through factoring helps distribution companies maintain a steady supply chain and respond to production demands without financial stress. This is especially useful during peak seasons so businesses can manage unexpected expenses and keep operations running smoothly.

Factoring allows distribution companies to focus on their core operations and growth without cash flow disruptions. Partnering with a reputable factoring company means these businesses get the financial support they need to succeed in a competitive market.

Client Testimonials and Success Stories

Client testimonials and success stories show the impact of factoring on business growth. Clients describe Porter Capital as excellent, easy to work with and good for their business growth. These real life examples show how businesses thrive with factoring services, so new customers can have confidence in partnering with a reputable factoring company.

How to Get Started with a Factoring Company

Getting started with a factoring company is a straightforward process that begins with submitting a factoring application. This application provides key information about your financial situation so the factoring company can assess your needs and offer tailored financial solutions. Factoring companies also request customer credit information to evaluate the risk of advancing funds against your invoices.

Once the application is submitted and approved businesses can get funded quickly, often within 24 to 48 hours. Partnering with a reputable factoring company means businesses get the cash flow they need to keep operations running and pursue growth opportunities without financial stress.

Summary

In summary financial factoring companies offer solutions for businesses with cash flow challenges. By providing immediate access to funds through the purchase of unpaid invoices these companies help businesses keep operations running, invest in growth and avoid financial stress. From invoice factoring to accounts receivable financing and freight factoring and factoring services the services of top factoring companies like Porter Capital and others mean businesses of all sizes and industries can thrive. By choosing the right factoring partner and understanding the benefits businesses can have a stable financial future and focus on their core operations.

FAQs

What is invoice factoring?

Many industries like trucking, healthcare, manufacturing, staffing, distribution and energy can benefit from factoring services. Using these services can improve cash flow and operational efficiency in these sectors.

How long does it take to get funded by a factoring company?

A business can get funded by a factoring company within 24 to 48 hours after submitting the required documents and getting approved. This fast turnaround means companies can address their cash flow needs.

What is the difference between recourse and non-recourse factoring?

The main difference between recourse and non-recourse factoring is liability: recourse factoring holds the business responsible for unpaid invoices, non-recourse factoring transfers that risk to the factoring company so it’s safer for the business.

What is the advance percentage in invoice factoring?

The advance percentage in invoice factoring is typically 70% to 90% of the invoice value. The balance is provided after the customer pays, minus applicable fees.