Reading Time: 6 minutes

Last updated: April 1, 2025

Whether you are a startup or a small to mid-sized company, the chance to sell to a big-box retailer can revolutionize your business. Selling to big-box retailers increases your potential sales and brand awareness as these popular chains have a large and established client base that can now access your product—But did you know Alternative Financing can help?

Working with big-box retailers is a great opportunity your company should take advantage of. Still, the reality is that supplying to large retailers may initially leave gaps in your funds or cause unforeseen cash flow challenges as you adjust to scaling up.

When you start selling to big-box retailers, discovering alternative financing options like invoice factoring and accounts receivable financing can ease the transition by boosting your cash flow so that you can go above and beyond the retailer’s expectations.

Benefits of Selling to Big-Box Retailers

Large brick-and-mortar chains have high standards for the vendors they purchase from. As a wholesaler, you need to be able to hit the ground running to meet the large volumes of sales. Your supply chain needs to be as efficient as possible. Meeting the retailer’s high expectations is worth it to enjoy the following benefits:

- You can increase sales and profits as you access a larger customer base.

- You can enjoy more coverage from a larger customer base, and association with a big-box retailer increases brand awareness.

- It is an asset to learn from how big-box retailers operate and to be able to apply that to your own business.

Alternative Financing Options

Selling to big-box retailers certainly has its challenges, such as high upfront costs, long payment cycles, and potential issues with cash flow and scaling to meet increased demands. Sometimes, there are expectations to contribute to your advertising and loyalty programs. There may also be fees for using the retailer’s systems. Accessing capital to fulfill the retailer’s needs isn’t always possible through traditional methods. In this case, exploring alternative wholesale financing options like invoice factoring or accounts receivable financing may be the answer.

Invoice Factoring

Invoice factoring for wholesalers is an alternative financing option that involves selling your unpaid invoices to a financial lender. You sell your invoices at a discounted rate, and in return, the financier gives you an advance on your invoice total.

One of the greatest advantages of invoice factoring is that the lending company collects full repayments on the invoices from your customers. Once the company receives payment from your customers, the financing company transfers the remaining percentage of your invoice amount after deducting their fees.

The company will also calculate your fees on several unique factors, including your customer’s creditworthiness and the total invoice amount. The company’s fee will also depend on whether you sign up for a recourse or non-recourse arrangement. With a recourse arrangement, you maintain ultimate responsibility for nonpayments, while with a non-recourse arrangement, the company accepts the risks of nonpayment and will write those off as losses.

Understandably, entering a non-recourse agreement is uncommon and when it does happen, you can expect to pay higher fees.

Invoice factoring is an excellent alternative financing option for several reasons:

- Instant access to capital: Slow payments can lead to gaps in your finances that are challenging to work around. Invoice factoring is a method of having instant access to cash without having to take out a loan.

- Improved cash flow: Waiting for payments can disrupt cash flow. In the meantime, your business needs to buy supplies and pay rent and salaries. Invoice factoring boosts your cash flow so that you continue to operate seamlessly.

- Accessible: Invoice factoring can be easier to qualify for than standard loans — especially if you are a startup company or working on improving your credit. Most factoring companies won’t require some form of collateral, either.

Purchase Order Financing

Purchase order (PO) financing, is a short-term financing method for a business to cover the costs of manufacturing or purchasing goods. PO financing works if your company has orders you need to fulfill but cannot immediately cover the costs to fill the order.

Here is a breakdown of how PO financing works:

- You receive an order from a customer but need funds to fulfill it.

- You apply to a financing company for PO financing and receive up to 100% to cover your supplier’s costs. You may not get the full amount, and the amount you receive depends on the creditworthiness of your customers and the supplier.

- The financing company pays the supplier directly.

- You invoice the customer with the lender’s details, and the customer pays the financing company directly.

- The finance company receives payment, deducts their fees, and transfers the balance to you.

One of the main disadvantages of purchase order financing is that your customers know they are paying a lender rather than your company, which may impact the relationship and your reputation. Other considerations include that you can only use these funds to cover supplier expenses.

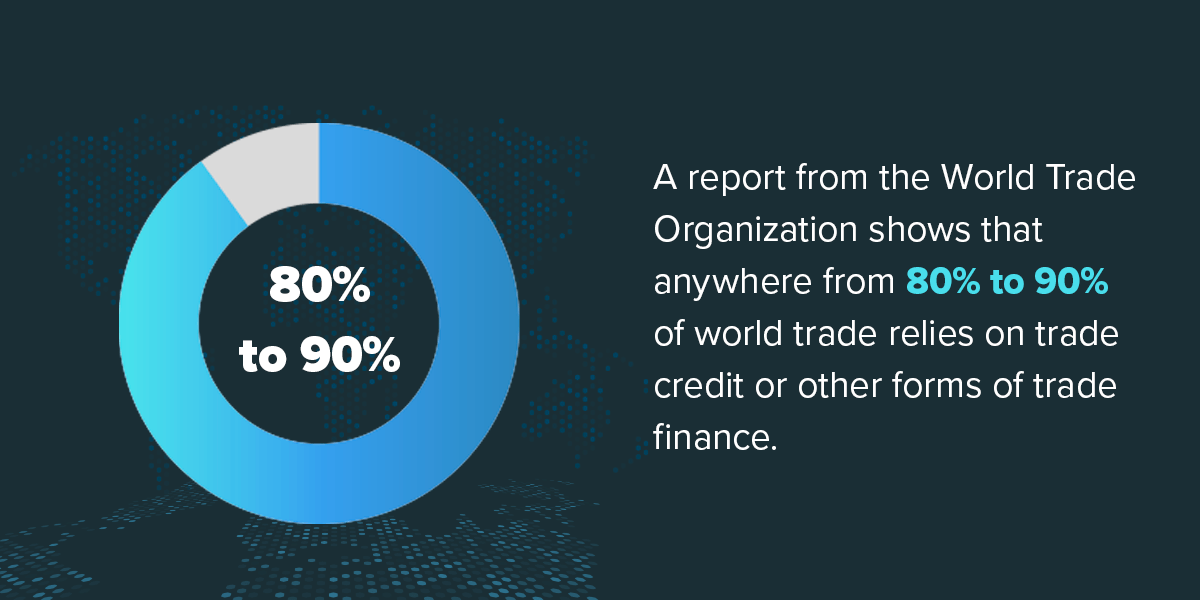

Trade Credit

Trade credit is a B2B arrangement that allows your company to purchase and receive supplies or services without making immediate payment — essentially, buy now, pay later. Trade credit has always been a vital part of B2B commerce. A report from the World Trade Organization shows that anywhere from 80% to 90% of world trade relies on trade credit or other forms of trade finance.

It is good to consider that there are different trade credit agreements, from open accounts and cash-on-delivery (CoD) to installment and revolving credit. The trade-credit option that best works for your company will depend on many factors, most importantly, the agreement you have in place with the big-box retailer you sell to.

Strategies and Tips for Implementing Alternative Financing Options

Your company has unique financial needs when you supply to big-box retailers, and it’s crucial to know how to choose and implement alternative financing options according to those needs. Consider these strategies for making the right call and making the most of it:

- Take some time to explore various options and providers and weigh the pros and cons of each financing solution. For example, you can weigh up fees over long-term gain and how each may affect your relationship with retailers.

- Build a solid relationship with the retailer you sell to and the financing company so that there is always transparency and you potentially enjoy greater insights or other benefits.

- Work with your financial team and financing provider to develop a comprehensive financial plan.

- Implement methods for monitoring and optimizing your financial strategies — an invoice factoring partner like Porter Capital can help your company accomplish this.

Find the Right Financing Solution With Porter Capital

Are you ready to sell to big-box retailers but need a financing solution that helps you get there? As an alternative lender, Porter Capital provides your company with flexible funding options that improve your cash flow so your business can continue growing.

We offer a straightforward application process so you can quickly access capital when your business needs it most. Explore our financing solutions for reducing debt and boosting cash flow or contact one of our experts today to get a quote for our effective capital solutions.