Common Misconceptions about Recruitment Invoice Factoring

I’ve come to appreciate just how crucial recruitment invoice factoring is for staffing agencies. It’s really about converting those unpaid invoices into immediate cash, giving agencies the breathing room they need. This financial approach ensures they can handle payroll and day-to-day expenses without that painful waiting game for client payments. I’ll walk through how it works, the benefits you’ll see, and what to keep in mind when picking the right factoring partner.

Key Takeaways

- Recruitment invoice factoring lets agencies turn those unpaid invoices into immediate cash, helping them cover payroll and operational costs without stretching their finances thin waiting for payments.

- Finding the right factoring company isn’t something to rush through; you’ll want to consider their industry experience, how upfront they are about fees, and whether they offer flexible terms that actually fit what staffing agencies need.

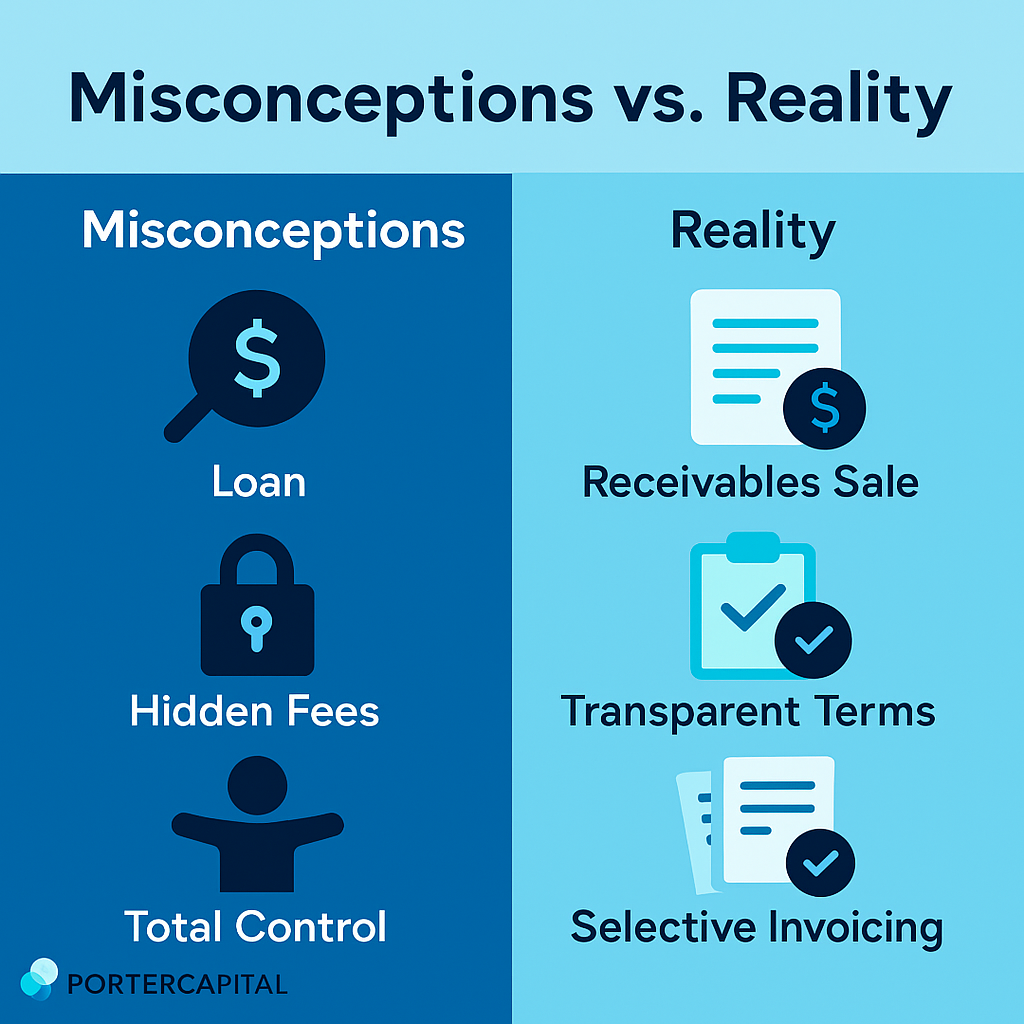

- I’ve noticed many folks misunderstand factoring, thinking it’s just another loan or that it’s loaded with hidden fees; truth is, it’s about selling receivables to improve cash flow without piling on debt.

Understanding Recruitment Invoice Factoring

Invoice factoring is when you sell your outstanding invoices to a finance company for immediate cash. For recruitment agencies, this practice—often called staffing factoring—serves as a vital form of invoice financing tailored to their unique situations. Recruitment businesses gain working capital by selling those unpaid invoices, turning them into cash right when they need it. This immediate access to funds helps agencies cover their operational costs, especially payroll, instead of playing that waiting game with client payments.

The whole point of recruitment funding solutions is to help businesses thrive by giving them the cash flow they need to manage their workforce effectively. When I look at flexible funding through staffing factoring, I see several key benefits:

- It lets agencies access capital on short notice without getting locked into long commitments.

- It’s particularly helpful because qualifying for staffing factoring is typically easier than going the traditional lending route.

- It focuses mainly on the creditworthiness of clients. Plus, recruitment finance plays a crucial role in supporting these funding solutions, including unlimited funding.

I’ve seen many staffing firms leverage invoice factoring to grab growth opportunities because they know they can pay workers promptly. Converting invoices into cash helps keep employee morale and trust high through timely weekly payroll. Payroll funding helps staffing companies make payroll before receiving payment from customers, ensuring smooth operations and happier employees.

Why Recruitment Agencies Need Invoice Factoring

From what I’ve observed, recruitment agencies often struggle with delays in client payments, and this really hinders their ability to meet payroll obligations. Clients might take their sweet time to pay, creating significant cash flow headaches for staffing firms. Reliable consistent cash flow isn’t just nice to have—it’s essential for these agencies to maintain operational stability and meet their financial commitments.

Invoice factoring allows staffing agencies to convert unpaid invoices into immediate cash, helping them overcome these cash flow challenges. It’s rewarding to see how factoring lets agencies focus on growth, taking on larger contracts without the stress of immediate cash shortages. This financial flexibility enables them to make decisions based on current opportunities rather than being limited by cash constraints.

Every conversation I have with agency owners confirms that payroll funding through factoring ensures they can pay employees on time, which is vital for maintaining morale and avoiding legal complications. Partnering with factoring companies also reduces the administrative workload tied to credit management and collections, allowing agencies to operate with less stress and fewer cash flow shortages.

How Recruitment Invoice Factoring Works

The process of recruitment invoice factoring begins like this:

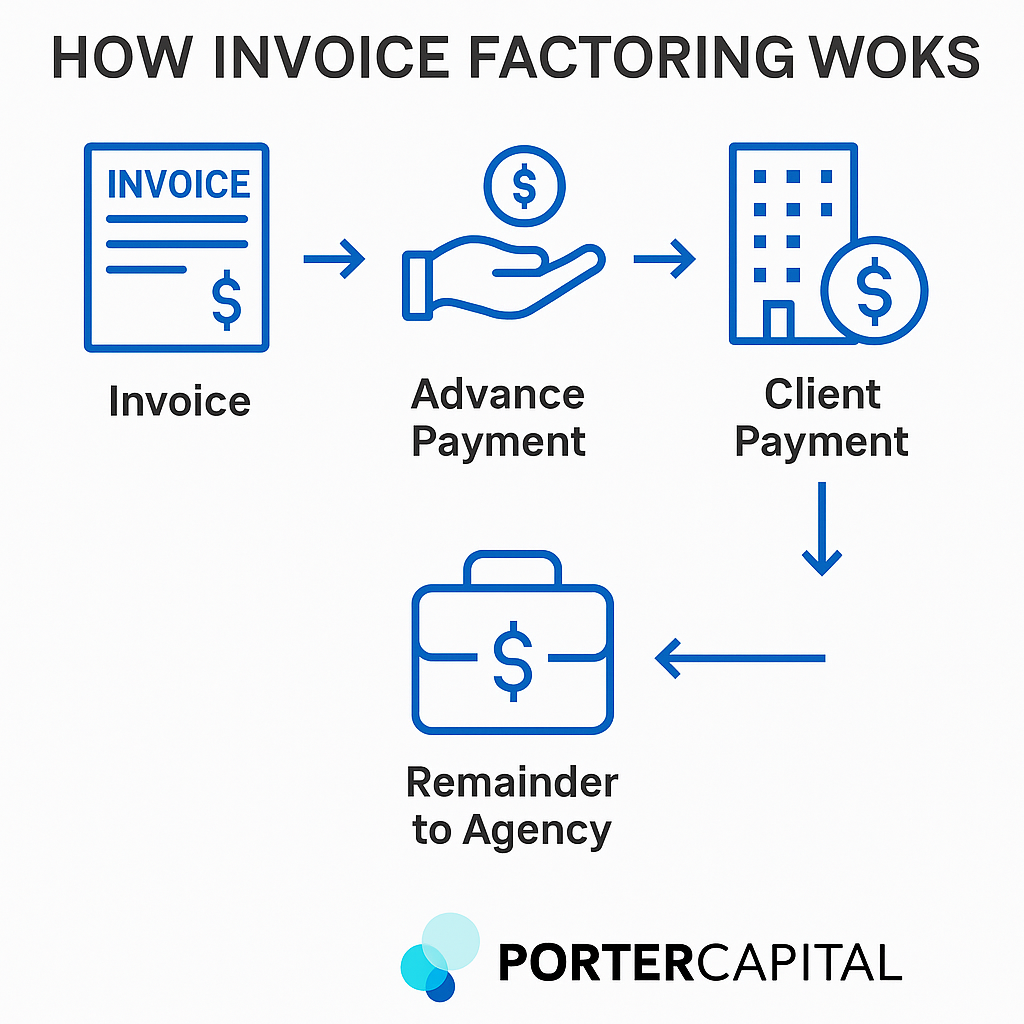

- Staffing companies submit their client invoices to a factoring firm.

- The factoring company provides an advance amount, typically within a few days, minus a fee for their services.

- This advance gives the recruitment agency immediate access to the funds they need to cover payroll and other operational expenses related to temporary recruitment.

Once the client pays the invoice, the factoring company settles the remaining balance with the staffing agency, completing the transaction. I find this process not only provides immediate cash flow but also shifts the burden of managing accounts receivable to the factoring company, allowing the recruitment agency to focus on what they do best when the customer pays and get paid.

Invoice factoring is a seamless and efficient way for recruitment businesses to manage their finances, ensuring they have the liquidity needed to operate smoothly. Now let’s look at the specific costs involved in recruitment invoice finance factoring.

Costs Involved in Recruitment Invoice Factoring

Factoring rates are a crucial aspect that impacts the overall costs. I’ve seen these rates vary among different factoring companies, and they’re determined by specific criteria, like the creditworthiness of the clients and the volume of invoices being factored. It’s important for recruitment agencies to understand these rates and how they’ll affect their bottom line.

Additionally, factoring companies may charge other fees, such as service fees or transaction fees, which can add to the cost. At the end of the day, carefully reviewing the fee structure and ensuring transparency helps recruitment agencies make informed decisions and choose the best invoice factoring options for their needs.

Terms and Conditions of Invoice Factoring

The terms and conditions of invoice factoring can vary significantly by company. Typical terms might include no minimum monthly invoice factoring requirements and a clear disclosure of all fees upfront to avoid hidden charges. This transparency is crucial for recruitment agencies to manage their finances effectively.

Another important aspect is the flexibility in choosing which invoices to factor. Too often, people believe that staffing agencies must factor all their invoices, but the truth is they can select specific invoices to sell for financing, maintaining control over their financial strategy. Additionally, some factoring agreements may include bad debt protection to cover instances where customers default on payments and other aspects of their financial management.

Benefits of Invoice Factoring for Recruitment Agencies

I’ve seen how invoice factoring provides immediate access to funds by allowing recruitment agencies to sell their unpaid invoices, significantly enhancing cash flow. This immediate cash influx enables agencies to meet payroll obligations and cover operational expenses without waiting for client invoice payments. Additionally, a cash advance can provide further financial support when needed.

Outsourcing invoice collections to factoring companies allows staffing agencies to concentrate on their core functions, like recruitment and workforce management in the back office. This not only reduces the administrative burden but also ensures that employees are paid on time, which is crucial for maintaining morale and productivity.

With improved cash flow, recruitment agencies can confidently invest in growth opportunities, such as hiring new employees and expanding their marketing efforts. I find it rewarding to see how staffing factoring solutions are tailored to the needs of recruitment agencies, allowing them to scale funding with their invoice volume and manage payroll flexibly.

Types of Invoice Factoring Available

Invoice factoring is a versatile financial solution that can benefit various staffing sectors, including:

- Healthcare staffing agencies, which ensure timely payments and maintain operational stability

- IT staffing agencies, which benefit similarly by ensuring timely payments and operational stability

- Administrative staffing agencies, also gaining from timely payments and operational stability

- Payroll companies, which utilize invoice factoring to improve cash flow for immediate expenses

I’ve noticed human resources staffing firms, consulting staffing companies, and manufacturing staffing firms often rely on invoice factoring to handle payroll and operational costs without delays. Accounting, janitorial, and professional staffing firms can also benefit from invoice factoring, as it provides immediate access to cash for business growth and operational needs.

Every conversation confirms that many types of staffing companies can benefit from invoice factoring, making it a valuable tool across various sectors. The flexibility and immediate cash flow it offers help recruitment agencies navigate financial challenges and seize growth opportunities.

How to Qualify for Recruitment Invoice Factoring

From what I’ve seen, staffing agencies typically qualify for recruitment invoice factoring by meeting these criteria:

- Selling invoices to other businesses

- Having customers with good credit standings, as the factoring company primarily considers the creditworthiness of the clients rather than the agency itself

- Maintaining a managed tax balance with relevant tax authorities

Staffing agencies need to meet the following criteria and considerations for invoice factoring:

- Demonstrate monthly sales of at least $5,000.

- If clients take longer than 30 days to settle their invoices, this may enhance suitability for factoring.

- Past denials of bank financing don’t automatically disqualify a staffing agency from obtaining invoice factoring.

Choosing the Right Invoice Factoring Company

I find that selecting the right invoice factoring company is crucial for maximizing the benefits of this financial solution. Important factors to consider include:

- The factoring company has a deep understanding of the staffing industry to facilitate a smoother process.

- The company offers tailored services specific to recruitment needs.

- The company provides better support and more efficient funding solutions.

When I talk with recruitment agencies about choosing factoring services, I emphasize these priorities:

- Services that cut down on the waiting game to start accessing funds.

- Technology that streamlines and speeds up the setup process, ensuring a quick and easy transition.

- Transparency about fees and competitive rates to avoid hidden charges and manage costs effectively.

Experience in the Recruitment Industry

It’s really about choosing a factoring company with experience in the recruitment sector as they have a better understanding of the specific needs of staffing agencies. An experienced factoring provider can better understand and meet the unique challenges faced by staffing agencies, leading to better service and faster support.

I’ve seen how a factoring partner familiar with staffing companies can expedite funding and improve communication with clients. This familiarity ensures that the staffing firm recruitment agency receives the tailored solutions it needs to thrive in a competitive recruitment business market.

Speed and Ease of Setup

Every conversation with recruitment agencies confirms they should seek factoring services that minimize the time it takes to start accessing funds. A streamlined technological setup can significantly enhance the efficiency of the factoring process, making it easier for agencies to manage their cash flow and cover payroll expenses promptly.

This ease of setup allows recruitment agencies to focus on their core new business operations without getting bogged down by administrative tasks. I feel it’s rewarding to help agencies choose a factoring company that prioritizes quick and easy setup, ensuring a smooth transition and immediate access to the necessary funds.

Competitive Rates and Flexible Terms

Understanding the fee structure and ensuring clarity in contracts is crucial before entering into an agreement with a factoring company. No hidden fees should be charged in invoice factoring agreements, making transparency essential for managing costs. For more detail, it’s important to review the terms carefully and consider a free consultation.

Too often, companies think that invoice factoring requires a long term contract, but it actually offers flexibility, allowing staffing agencies to negotiate short-term agreements that suit their needs. I always suggest looking for factoring companies that offer customizable funding options based on specific business needs. This flexibility ensures that the recruitment agency can adjust its funding strategy as its business grows and evolves.

Comparing Invoice Factoring with Traditional Bank Loans

From my experience, factoring services reduce exposure to credit risk by evaluating the creditworthiness of client businesses and their credit history, making them a more secure option for recruitment agencies. Businesses with poor credit or no significant assets may find invoice factoring to be a more viable option than traditional bank loans. This is because factoring approvals focus on the creditworthiness of the clients rather than the business owner’s credit score, which may involve credit checks and credit control. Additionally, businesses can obtain credit through this method more easily, and credit insurance can further enhance their financial security.

Invoice factoring provides faster access to cash compared to bank loans, which have a lengthy approval process. Unlike traditional loans dependent on borrower creditworthiness, factoring is based on the credit risk of the staffing agency’s customers. I’ve found this financing option is accessible for businesses that may struggle with traditional loans, focusing on clients’ credit rather than the agency’s.

While the cost of invoice factoring may be higher over time, it allows for quicker funding than traditional loans. Additionally, unlike bank loans, invoice factoring doesn’t require collateral beyond the receivables being factored. This makes it an attractive option for recruitment agencies looking to maintain financial flexibility and avoid the constraints of traditional lending.

Common Misconceptions About Recruitment Invoice Factoring

One common misconception I encounter is that payroll funding through invoice factoring is akin to taking out a traditional loan. In reality, it’s the sale of receivables, which provides immediate cash flow without creating debt. Recruitment invoice factoring provides immediate cash flow by selling unpaid invoices to a factoring company, allowing agencies to meet their financial obligations without the burden of debt.

Another misconception is that invoice factoring involves hidden fees. However, reputable factoring companies disclose all fees upfront and ensure transparency in their agreements. Understanding these terms helps agencies make informed decisions without worrying about unexpected costs.

Lastly, some believe that factoring companies take control of all invoices. In truth, staffing agencies can choose which invoices to factor, maintaining control over their financial strategy. This flexibility allows agencies to manage their cash flow effectively and avoid a cash flow nightmare.

Summary

Looking back at all we’ve covered, recruitment invoice factoring offers a lifeline to agencies struggling with cash flow issues and delayed client payments. By converting unpaid invoices into immediate cash, agencies can cover payroll and operational expenses, invest in growth opportunities, and maintain employee morale. The flexibility, reduced administrative burden, and immediate access to funds make invoice factoring an attractive option for recruitment businesses.

As we’ve explored, understanding the costs, terms, and benefits of invoice factoring is crucial for making informed decisions. I find it rewarding to help recruitment agencies choose the right factoring company with industry experience, transparent rates, and a quick setup process, so they can navigate financial challenges and seize growth opportunities. Consider invoice factoring as a strategic financial tool to ensure your recruitment business thrives.

Frequently Asked Questions

What is recruitment invoice factoring?

Recruitment invoice factoring allows agencies to sell unpaid invoices to a finance company for immediate cash, effectively aiding in cash flow management and covering essential operational expenses like payroll.

How does invoice factoring benefit recruitment agencies?

Invoice factoring benefits recruitment agencies by providing immediate access to funds, reducing administrative tasks, and allowing for timely payroll payments, which in turn helps maintain employee morale. This financial flexibility also supports investment in growth opportunities.

What are the costs involved in recruitment invoice factoring?

The costs of recruitment invoice factoring typically include factoring rates, service fees, and transaction fees, which can vary based on the factoring company and the client’s creditworthiness and invoice volume. It’s essential to consider these factors when evaluating your options.

Can any recruitment agency qualify for invoice factoring?

Yes, recruitment agencies can qualify for invoice factoring if they sell invoices to other businesses, their customers have good credit, and they maintain monthly sales of at least $5,000. Other factors like tax balances and invoice settlement periods may also affect eligibility.

How does invoice factoring compare to traditional bank loans?

Invoice factoring provides quicker access to cash without requiring collateral beyond receivables, making it suitable for businesses with poor credit or limited assets. In contrast, traditional bank loans typically involve a lengthy approval process and rely heavily on the business owner’s credit score.