Table of Contents - Quick Links

In today’s challenging economic landscape, businesses are facing a significant tightening of credit, with limited access to essential financing from traditional sources. Small and mid-sized businesses are particularly affected by this shift, finding themselves in need of reliable financial solutions. In this economic climate, it is paramount for businesses to proactively research and secure alternative lending options. By taking action now, companies can ensure access to necessary funding for a multitude of what-if scenarios, maintain financial stability, and seize new business opportunities that lie ahead.

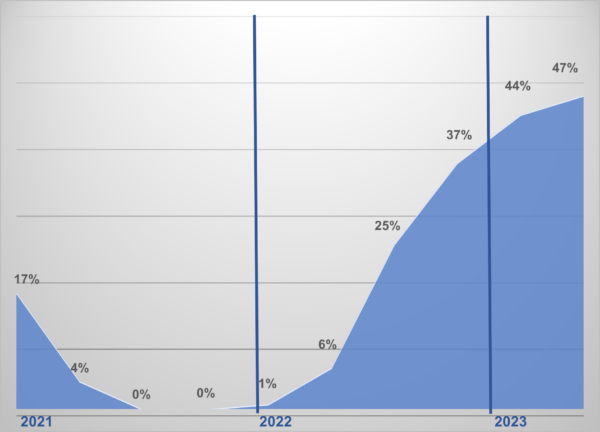

Tightening of Banks’ Standards for

Commercial & Industrial Loans

According to the Federal Reserve’s quarterly survey of senior loan officers (1), banks nationwide are tightening their credit standards for business lending. The graph above shows the average number of banks that have reported tightening their credit standards for large, middle-market, and small firms. This means that many businesses are now either ineligible for bank lending or will soon no longer meet the criteria to obtain new funding. As such, many business owners have sought out alternative financing to support their operations.

Importance of Business Liquidity

A strong foundation of liquidity is crucial for ensuring the seamless functioning and overall financial well-being of a business. It provides the necessary flexibility to respond to unexpected expenses, economic downturns, or changes in market conditions. Businesses achieve liquidity by strategically managing a combination of cash reserves, short-term investments, and the ability to quickly convert assets into cash, such as accounts receivable or marketable securities. The advantages of maintaining adequate business liquidity extend beyond immediate needs and provide both short-term and long term-benefits.

Short-Term Benefits

- Meeting Expenses: having adequate funding allows businesses to meet day-to-day operational costs seamlessly, ensuring continuity and stability.

- Maintaining Competitive Edge: With readily available funds, businesses can invest in strategic initiatives, marketing efforts, and talent acquisition, positioning themselves as a frontrunner in the industry.

- Expanding Research and Development: Access to liquidity enables businesses to allocate resources to innovation, fostering continuous growth and product or service enhancements.

Long-Term Opportunities

- Considering Acquisitions: Having a strong financial position, allows businesses to explore acquisition opportunities that align with their growth strategy, potentially expanding their market presence and diversifying their offerings.

- Winning Market Share: With the flexibility to lower prices strategically, a business can attract a larger customer base, ultimately increasing its market share and solidifying its position as an industry leader.

- Enhancing Negotiating Power: A solid financial foundation empowers businesses to negotiate favorable terms with vendors, suppliers, and other stakeholders fostering stronger relationships and increasing profitability.

By researching alternative leading options now and securing financing, your business will be equipped with the financial resources necessary to navigate any challenges and seize growth opportunities.

In a Tightening Credit Market?

Looking for a lifeline in contracting credit market? Porter Capital can help with multiple alternative financing options.

Understanding Your Financing Options

As conventional lenders become more cautious, alternative financing solutions are gaining prominence. Accounts receivable financing, in particular, has become a go-to resource for startups and established businesses alike. This financial service allows businesses to quickly convert their accounts receivable into immediate cash, empowering them to maintain a healthy cash flow and effectively manage their operations while awaiting invoice settlements.

The Advantages of Alternative Financing

Alternative lending services provide a lifeline for businesses of all sizes, bridging the gap created by stricter lending requirements. By leveraging alternative lending, businesses can access the necessary funds to cover day-to-day expenses, invest in growth initiatives, and capitalize on new opportunities. Compared to traditional loans, alternative financing options offer distinct advantages, such as faster access to capital, reduced risk, and increased flexibility. Porter Capital’s personalized approach ensures that each business receives tailored financial solutions that align with its unique needs and circumstances.

- Faster Access to Capital: Traditional loans can involve a lengthy approval process and extensive documentation requirements. However, alternative financing provides businesses with a streamlined and expedited funding solution.

- Reduced Risk: Collateral requirements and strict eligibility criteria can pose significant risks for businesses. In contrast, alternative financing shifts the focus to the creditworthiness of the client’s customers. In addition, the responsibility of collecting accounts receivable is shifted to the lender.

- Increased Flexibility: With alternative financing, the amount of funding available can increase as the business grows. Businesses can control their cash flow management, ensuring they have funds available precisely when needed.

In an environment where credit is tightening, businesses need reliable and flexible financing options to navigate uncertain times successfully. Porter Capital understands these challenges and is committed to supporting businesses nationwide by providing the necessary funds through alternative financing. With a simple application process, once approved, payments can be delivered in as little as 24 hours. Porter Capital is dedicated to ensuring your business’s success. Contact us today to discover how our flexible financing options can propel your business forward in the face of a tightening credit market.

Footnotes:

(1) – Percentage of banks that are tightening business credit standards. Blayne Hyatt based on data from the Federal Reserve.